Taiwan general insurance industry growth tapers off in 2022

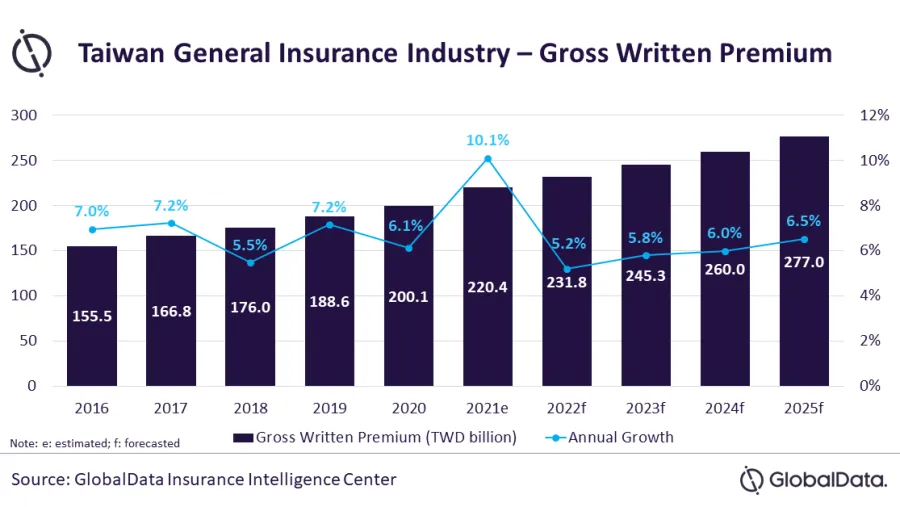

Gross written premiums’ annual growth rate peaked at 10.1% in 2021.

Taiwan’s general insurance industry’s growth lulled after 2021, a report by data and analytics firm GlobalData revealed.

Annual growth rate of gross written premiums (GWP) peaked at 10.1% in 2021, and will slow down to 5.2% in 2022, growing at a compound annual growth rate (CAGR) of 6.7% from TWD200.1bn ($6.8bn) in 2020 to TWD277.0bn ($10.4bn) in 2025.

According to GlobalData senior insurance analyst, Deblina Mitra, despite being a developed economy, Taiwan’s general insurance industry’s penetration, as a percentage to gross domestic product (GDP), is at around 1%, which is way below the developed markets’ average of 4%. Mitra said that this is due to lower uptake of insurance lines such as property and liability.

“To bridge the gap, in recent years, the government and regulators have taken steps to diversify the industry with notable developments registered in liability and agricultural insurance lines. This includes the 2021 regulation, in which the government made occupational accident insurance mandatory for all employees,” Mitra said.

Motor insurance, which accounts for 53.7% share in terms of GWP, grew by 7% in 2020. An increase in premium prices and strong growth in vehicle sales helped its growth. However, the short-term outlook for motor insurance remains negative due to the global shortage of semiconductors. Overall, the motor insurance GWP is expected to grow at a CAGR of 5.9% over 2020–2025.

Property insurance is the second-largest general insurance line with a share of 20.1% of the GWP in 2020. Property insurance grew by 11.4% in 2020, driven by growing demand from the real estate, manufacturing, and infrastructure construction sectors. An increase in premium rates linked to natural hazard insurance also contributed to the growth. Taiwan is highly vulnerable to earthquake risk and covers earthquake insurance as default within all fire insurance policies.

The introduction of ‘The Farmers’ Insurance Act’ in 2021, which paved the way for insurers to develop solutions covering risks faced by farmers, will create new opportunities. As a result, property insurance is expected to grow at a CAGR of 5.3% during 2020-2025.

Personal accident and health (PA&H) is the third-largest insurance line with a GWP share of 10.7% in 2020. Taiwan’s transition into a super-aged society over the next five years is expected to enhance the demand for health insurance, which is expected to grow at a CAGR of 5.8% over 2020-2025.

Other insurance lines including liability, marine, aviation, and transit (MAT) and financial lines accounted for the remaining 15.5% share in 2020.

“Taiwan’s low insurance penetration and strong export-oriented manufacturing sector provide ample opportunity for general insurance growth. Stable economic factors coupled with the government’s initiatives to expand the general insurance industry through new product development are expected to support its growth over the next five years,” Mitra said.

You may also like:

Taiwan life insurance industry to reach $121.2b in 2025

Advertise

Advertise