Thai life premiums to hit $22.8b in 2025

Whole life plans drive the sector, accounting for 72% of premiums in 2020.

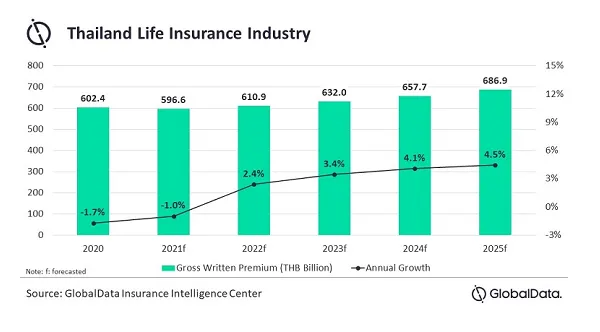

Thailand’s life insurance industry is projected to hit $22.8b (THB686.9b) in gross written premiums by 2025, according to a GlobalData report, with an expected compound annual growth rate (CAGR) of 2.7%.

The sector is driven by whole life insurance, which accounted for 72% of life premiums in 2020, said GlobalData practice head of insurance Ashutosh Sharma, but the sluggish economy and muted investment reduced policyholders’ appetite for unit-linked policies.

In addition, the country’s aging population prompted life insurers to overhaul their product mix and prioritise sustainable growth. This will affect product offerings with more focus on standard insurance products instead of investment linked plans, the report said.

Insurers are also offering benefits to customers like discounts on premiums and extension on premium renewal dates to support renewals. Furthermore, increased awareness and COVID-19 assistance offered by life insurance policies supported growth of the life segment in 2020.

Advertise

Advertise