Insurers ready to tackle Cyclone Jasper – ICA

The community in the cyclone warning region is advised to monitor weather conditions and follow guidance from emergency services.

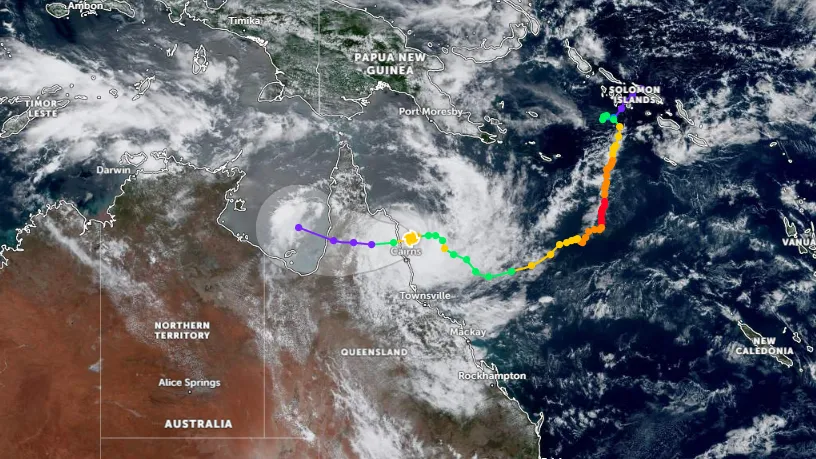

The Insurance Council of Australia (ICA) said insurers are prepared to respond to Cyclone Jasper, a category two system approaching the Queensland coastline near Cairns.

Disaster response specialists are on standby, and the ICA is coordinating with the State Government, Queensland Fire and Emergency Services, Queensland Reconstruction Authority, and the National Emergency Management Agency for readiness.

ICA and insurers have been closely monitoring Cyclone Jasper, and it has made landfall today, according to the Bureau of Meteorology.

While the trajectory of cyclones is inherently uncertain, Cyclone Jasper is expected to bring strong winds, heavy rain, and storm surge, prompting severe weather warnings from Cape Melville to Townsville.

In anticipation of the cyclone, insurers have activated emergency response procedures and are prepared to support and prioritise customers in affected communities.

ALSO READ: ICA picks out seven catastrophe-related areas insurers need to improve on

The community in the cyclone warning region is advised to monitor weather conditions and follow guidance from emergency services. Safety measures include clearing properties and gutters of loose material, securing boats or vehicles, and moving cars under cover.

Andrew Hall, CEO of ICA, emphasised the importance of community safety during this unpredictable weather event. While it's too early to determine the cyclone's intensity and trajectory, insurers are ready to assist customers and alleviate the stress associated with the event. Disaster response specialists are on standby to move into affected communities and help with claims as necessary.

Hall urged local communities to stay informed about weather conditions, heed advice from emergency services, and be prepared for potential evacuation instructions.

Advertise

Advertise