WTW’s net income surges 48% YoY in Q2 2024

Its revenue increased by 5% YoY to $2.3b.

WTW’s second quarter (Q2 2024) net income surged nearly half (48%) on a year-on-year (YoY) basis from the previous year to $142m.

Its revenue increased by 5% YoY to $2.3b, driven by 6% organic growth.

Diluted earnings per share (EPS) rose 55% YoY to $1.36, whilst adjusted diluted eps climbed 24% to $2.55 compared to the previous year.

The company's operating margin improved by 280 basis points to 9.4%, and the adjusted operating margin increased by 240 basis points to 17.0%.

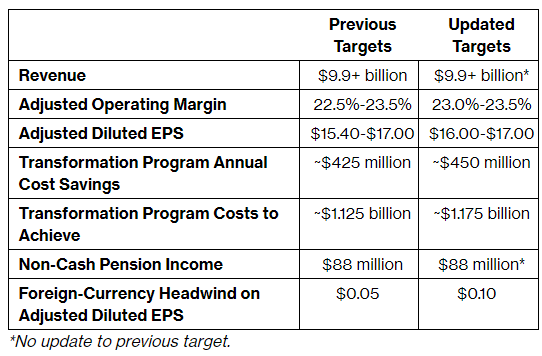

In light of these results, the company has raised the low end of its target ranges for 2024's adjusted operating margin and adjusted diluted EPS, and it has also increased its annual cost savings target.

Advertise

Advertise