YF Life Insurance International faces challenges in new business margin

Fitch anticipates it will continue focusing on capital efficiency and product diversification.

YF Life Insurance International is seen to maintain its strong capitalisation levels, Fitch Ratings assessed.

Its Hong Kong risk-based capital ratio stood at 234% in the third quarter, well above the regulatory minimum of 100%.

Fitch anticipates the company will continue focusing on capital efficiency and product diversification whilst maintaining a debt-free capital structure.

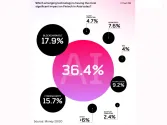

Fitch also projects stable financial performance for YF Life, with return on equity averaging 6.4% over 2023 and the first half of 2024.

However, the insurer faces challenges in its value of new business margin due to shifts in its product mix and heightened competition.

The company is expected to further reduce the duration mismatch between assets and liabilities to mitigate exposure to interest rate volatility.

Fitch noted that liability duration has been lengthening faster than asset duration under declining interest rates, prompting YF Life to acquire long-term US-dollar bonds and bond-forwards to extend asset duration.

Investment risk remains low, with Fitch forecasting a continued conservative asset management approach.

Advertise

Advertise