Rising medical costs put pressure on Thai health insurers: Allianz CEO

Public spending on health may be unsustainable in the long run.

Thailand's health insurers may be unable to sustain their operations in the long run due to rising medical costs, which are also squeezing the state’s budget for health, according to Allianz Ayudhya Assurance Pcl.’s CEO.

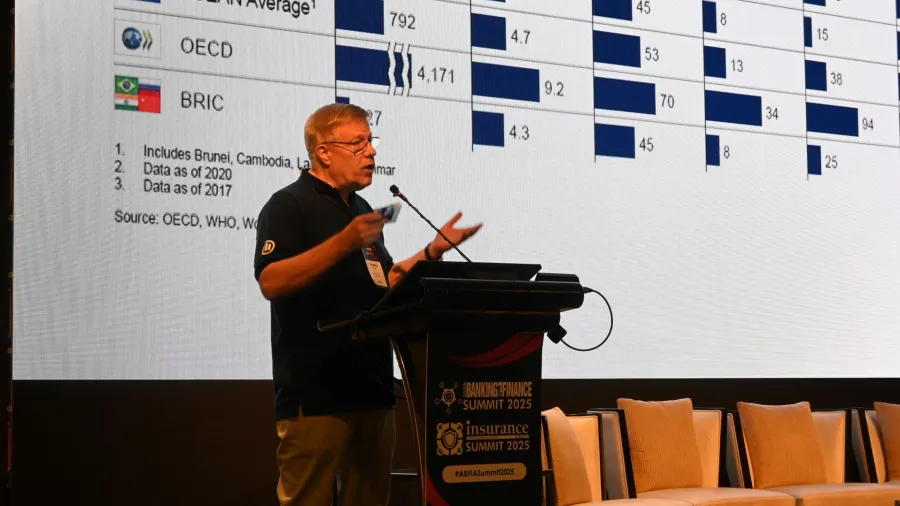

“There’s a silent revolution happening,” Thomas Wilson, country manager, president and CEO at Allianz Ayudhya Assurance, told the Asian Banking & Finance and Insurance Asia Summit in Bangkok last 18 February.

He cited rising inflation for claims, with most companies having switched to deductible-based plans. “The industry, the government and the payers are facing challenges with regards to sustainability… And I think it's important to raise awareness of these challenges up front before they become a crisis.”

Public healthcare expenditure is projected to rise 6.4% annually, whilst private healthcare spending could climb much faster at as much as 10%. At these inflation rates, the cost of healthcare in the Southeast Asian nation could double in about seven to eight years, Wilson said.

High medical inflation can affect an insurance company's profit margins, putting pressure to find ways to cut costs. The steadily increasing state budget allotted to health will also be difficult to sustain in the long term.

Policymakers, insurers, healthcare providers and consumers must work together to sustain health insurance even if Thailand’s healthcare infrastructure remains competitive, Wilson said.

The country has a higher-than-average level of government-funded healthcare in Asia and remains a leader in medical tourism, generating about $800m in revenue in 2024 — twice that of Malaysia, its closest competitor.

However, much of this revenue stems from elective procedures, such as cosmetic surgery, which does little to ensure long-term affordability for local patients, Wilson noted.

The government funds about 70% of Thailand’s healthcare costs, covering programmes such as social security and state employee benefits. The rest is split between private insurance at 18% and out-of-pocket expenses.

The private insurance sector is expanding faster than public programmes, fueled by rising incomes, heightened health awareness after COVID-19, and limited state-funded healthcare. Private insurance is also more flexible since it lets policyholders choose providers and access a range of treatments.

“COVID, higher health awareness, and increased middle class with greater flexibility of private insurance is driving a higher proportion of growth rate into the private insurance sector,” Wilson said.

He said preventative care could help reduce insurance claims. He noted that if musculoskeletal disorders were no longer in the top three claim categories, the insurance industry could free up more resources for critical illnesses such as cancer and stroke.

The Thai government might also need to mandate that private health insurance policies include deductibles to curb excessive claims, similar to what Singapore and Malaysia do, Wilson said.

Healthcare providers, meanwhile, should focus on cost-effective care, he said, noting that patients compete for the same hospital beds as international medical tourists seeking non-emergency medical procedures.

Wilson said Thailand’s insurance sector faces a challenge in the next five to 10 years. “Can I afford in 15 to 20 years the health care that I need? And based on the data that we've seen, I would say that the challenge is real.”

Advertise

Advertise