Climate risk is burning billions and Asia remains vulnerable

In 2021, the largest recorded natural disaster in the region cost over $2b.

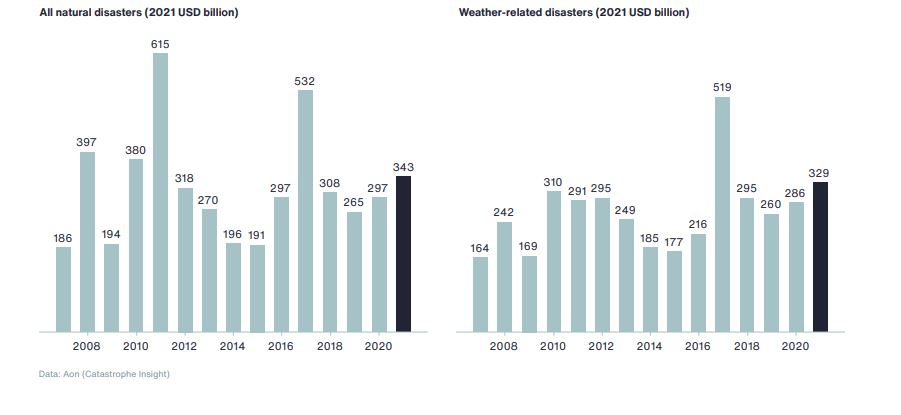

Natural disasters are definitely inevitable, but what continues to worry insurers is that these catastrophes are costing them a heftier price tag than ever. In Aon’s 2021 Weather, Climate, and Catastrophe Insight, economic losses for 2021 were estimated to be around $343b with only $130b insured. This marks the seventh costliest year on record, with a protection gap of at least 62%.

Whilst this is not a record-breaking year, far below the peak losses of $615b in 2011 and $532b in 2017, it was still above the average of $272b and the median of $265b of the 21st century. Comparing the last decade, between 2011 to 2020, economic losses were just 4% higher than the average and 15% higher than the median.

Economic losses were found to be solely resulting from weather and climate-related events defined as atmospheric-driven phenomena, totalling $329b. This is the third-highest loss on record.

Aon pointed out that driving the cost of these economic losses that topped the $20b threshold were just four individual events, namely Hurricane Ida, the July Flooding in Europe, the Summer Season Flooding in China, and the February Polar Vortex in North America.

These four economic losses collectively topped $300b. If this continues, it would be impossible for insurers to properly cover these losses without a hike in premiums.

Asia’s vulnerability

Speaking at the Willis Towers Watson (WTW) Asia Pacific Risk Virtual Conference, Gillian Tan, Assistant Managing Director of the Development & International Group of the Monetary Authority of Singapore, stressed the urgent need for climate action, especially in Asia, as it is geographically prone to natural catastrophes.

“The costliest natural disaster in 2021 was the flood in Henan province in July which resulted in a total economic cost of over $2b as of September last year, and this number is only expected to head north,” Tan said.

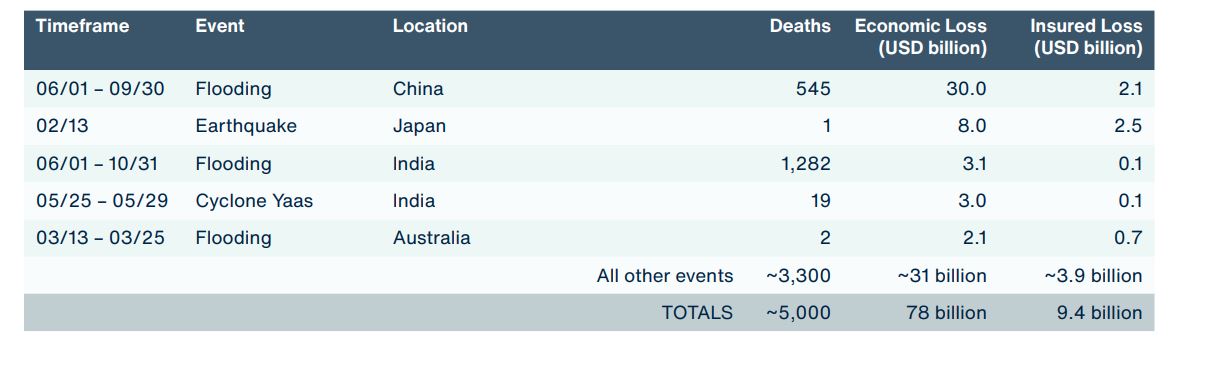

In Aon’s report, economic loss from flooding events between 1 June to 30 September 2021 in China stood at $30b. This makes it the number one most significant natural disaster event in 2021 in the Asia Pacific (APAC).

Aon said flooding events make up 55% of the economic losses in 2021, with China flooding events being the most significant natural disaster event for the second year in a row.

What is even more alarming is that, out of the $30b, only $2b were logged as insured losses. Out of the $78b of economic losses, only $9.4b or around 12% were covered by insurance. This highlights the underinsurance gap in the region.

“Amidst this sobering backdrop, what has been taken for granted all along is now clear: our interconnected and interdependent global system is incredibly fragile and vulnerable,” Tan said.

Losses in 2022

In Aon’s Global Catastrophe Recap, global preliminary loss for the first quarter of 2022 is now at $32b, with public and private insurers covering around $14b.

“The first quarter is typically the quietest of the year, though 2022 marked the sixth consecutive year to record more than $10b in insured losses,” Aon said.

What contributed most to the global loss is fluctuations in temperatures and precipitation influenced by the continued effects of La Niña across the central and eastern Pacific Ocean. These influences resulted in notable hazard events, including prolific and record-setting rainfall along Australia’s East Coast, continued severe drought conditions in parts of Africa, South America, and the western United States, and an earlier start to severe weather season in the United States.

APAC logged the highest percentage of first quarter economic losses at more than $15b, followed by Europe, Middle East, and Africa at $8b and the US at $6b. Aon predicts that event loss totals will continue to develop in the weeks and months ahead due to many large-scale and impactful events in March.

Demand for resiliency

In her speech, Tan said there is a demand for resilience capabilities, as well as opportunities for the insurance and finance sector amidst the rising cost of climate calamities.

The obvious danger that climate risk brings is that it will result in structural shifts to many firms' risk-return profiles.

“More frequent catastrophic events can cause severe impairment to business models, lead to substantial income and productivity losses, and make certain tail risks uninsurable, or insurable only at unaffordable rates,” Tan explained.

According to a research released by Swiss Re Institute, it was estimated that if no action on climate change is taken, Asia’s economy would be 26% smaller in 2050 whilst ASEAN’s economy would shrink by 37%.

“Asia’s insurance markets are growing, but the pace of growth will not be able to match the region’s growing protection needs from natural catastrophes. A distinct lack of high quality and standardised data to accurately quantify risk exposure for climate risks or to build reliable models also remains a key challenge,” Tan said.

Tan pointed out that countries, communities, and corporations are keen to build resilience capabilities across multiple dimensions – human, financial, operational, and technological. These are done through methods, such as partnerships between insurers and tech players, to widen the reach of insurance through a more accessible medium.

“Beyond these resilience capabilities, which all governments and corporates need to urgently develop, there will be opportunities for insurers and reinsurers to help build societal and corporate resilience and manage ever-present risks,” Tan said.

Green financing

For Tan, it is not enough to close the underinsurance gap. Insurers, themselves, must shift focus to greener financing.

Insurers provide risk financing, which is instrumental to the functioning of key sectors and infrastructure, including the energy and chemicals, aviation, and shipping sectors.

“Some of these sectors form a sizable part of global and Asian economies but are not inherently ‘green’. Risk financing and insurance can be an important lever in engaging the relevant stakeholders and supporting a progressive low-carbon transition of these sectors,” she said.

Tan urged insurers to work closely with their clients in these sectors as part of the underwriting process. This will help them better understand and engage them on climate risk exposures, transition plans and pathways, and support them with risk management analytics and insights.

“Ideally, insurers should journey alongside clients so that they make concrete and progressive improvements in their environmental performance over time,” Tan said.

*****

You may also like:

EXCLUSIVE: Women in insurance: What’s blocking the way to diversity?

EXCLUSIVE: The life-changing ‘crash’ of PGA Sompo’s CEO

COMMENTARY: HK insurers’ response to sustainability challenges

Advertise

Advertise