KoverNow: The Netflix of insurance?

Its subscription model gives another option for consumers that don’t want long contracts.

Subscription-based services are the most in-demand business model, with 78% of adults globally enrolled in a subscription service of a kind according to Zuora’s Subscription Economy Index report in 2021. The survey also revealed that three out of four people believe that in the future, people will subscribe more to services.

This was what Stephan Kaiser, CEO of insurtech firm KoverNow was banking on when he created the company in 2019.

Beginnings

Talking with Insurance Asia, Stephan, who is a former investment banker, explained that his experience in his last job initially brought him close to the insurance industry. He used to raise capital and debt for insurance firms. Whilst working in the industry on a project basis, he came to realise that even though most banking services have evolved to adapt digitally, most insurance services have not.

“I thought that was becoming an obvious pain point. So when I thought I spent enough time in investment banking I thought it was time to do something else. That’s when I move to insurance,” Stephan explained.

Stephan first started the company in the UK in 2019 but decided to uproot and go to Singapore as he believes that there is more demand for his vision of an insurance model in Asia, particularly in Southeast Asia.

Netflix for insurance

Stephan described that platform is like Netflix. This means customers can decide whether they will get the monthly subscription or the yearly one. They can also ‘turn off’ their subscription whenever they want.

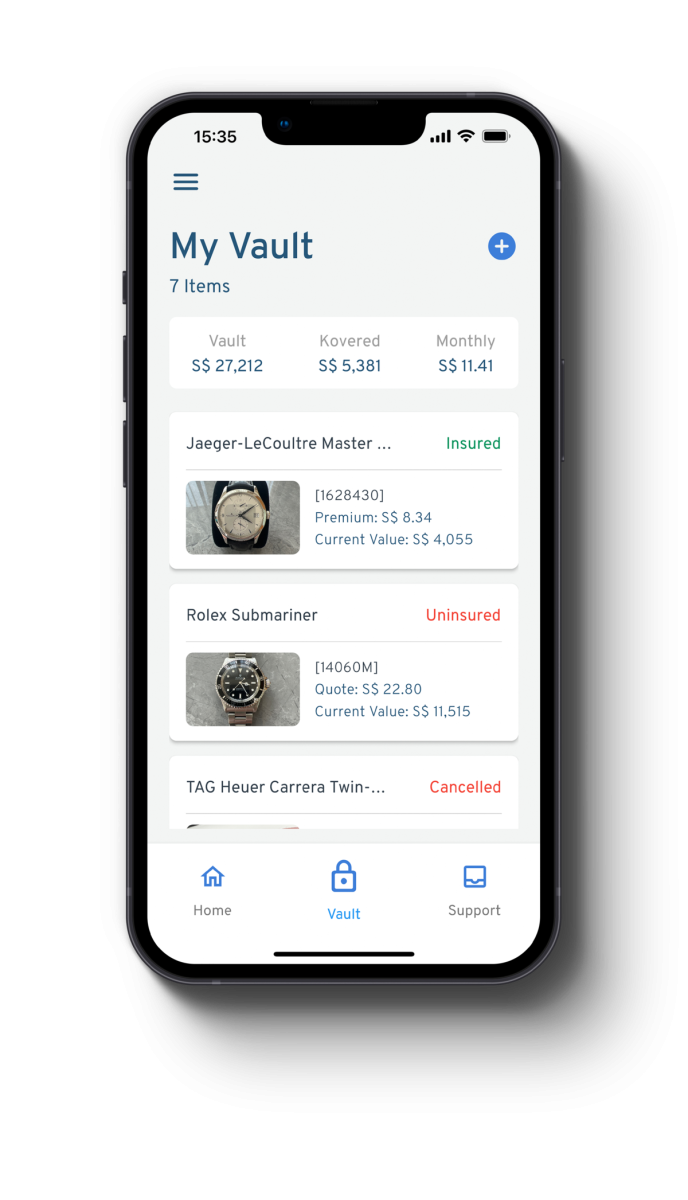

KoverNow’s main product is called Items Kover. It is an insurance product that covers luxury items such as jewellery, watches, cameras, handbags, laptops and more. The way it works is that a customer can register their luxury items in the app and ‘subscribe’ to insurance whenever they have to use it or take it out.

“The way it works is that for each of those categories, we have an underlying database. For example, for watches, we have 35,000 watches in our database that we know all the details of. And because we know all the details, we can establish a current market price for every one of those watches every day,” Stephan said.

This means, that users who register an item for evaluation get an almost instantaneous number of how much that watch is worth in the current market and how much the insurance will cost.

“Let’s say a watch is worth $4,950. If you register it in the app, we can immediately give you an executable policy price to insure that watch for 30 days. The whole thing is digital,” Stephan explained.

With the way it also works, if the value of the item in the market goes up, the premium for it automatically goes up in the app as well which is part of KoverNow’s agreed-upon policy.

And that coverage is on a global scale. Aside from North Korea, once consumers insure the item, it will be covered.

KoverNow also made making claims easier. If the insured item is lost or damaged, all you have to do is answer a few questions about what happened, and submit a police report if loss or a photo if damage. Then all the app will ask for you next is your personal information and a bank account where they will send the claim.

“That's only possible because everything is compartmentalized in digital. And we can take those things and put them together, as we need for the customer to have a good user experience,” Stephan said.

A growing market

In a recent campaign, KoverNow is giving the spotlight to insuring luxury watches.

This is a calculated business move according to Stephan because the global luxury watch market is around $30b and is expected to grow to $33b by 2026.

“And the interesting part is that Asia Pacific, not just Singapore, is the dominating region within that pie. Additionally, Singapore is great market for luxury watches, especially Swiss watches. In fact, there have been S$3b ($2.11b) worth of watches sold in Singapore this year,” Stephan explained.

Crunching the numbers, the potential premium income of ensuring that S$3b worth of watches is around S$60m.

This is quite a sizeable income because a lot of these watches, Stephan said, just sit at home or in banks, having only the minimal risk of lost or damage.

Narrow focus

Aside from luxury items insurance, KoverNow is currently on the verge of releasing three more insurance products: pet insurance, mobility insurance, and travel insurance.

Unlike other market players, Stephan said they’d rather put a narrow focus on the products they are releasing meaning they won’t offer the same type of insurance with different coverage but create just one product each.

Stephan likened this business decision to growing flowers or in KoverNow’s case, one flower.

“If you only grow one flower, you will gain a greater understanding of that flower, how much water it needs, when to plant the seeds and whatnot. We don’t want to offer 10 different motor policies. What we want is to offer one really smart product that does the trick,” Stephan said.

Future plans

Aside from the proof-of-concept grant they received from the Monetary Authority of Singapore’s Financial Sector Technology Innovation programme in 2021, KoverNow has been bootstrapped until now.

Stephan said if they do a funding round, they wanted to partner with someone who can help them take off and spread through Southeast Asia.

They are also hoping to launch their travel insurance product soon. The idea of it is to automate everything just by providing the flight details. This means that if a flight is cancelled or delayed, KoverNow will automatically pay you even without the need for getting a waiver from the airline.

For Stephan, he envisions KoverNow to be the smartest and most convenient, mobile-based insurance platform in Southeast Asia.

“If that means we become a household name, why not? We want to be in three to four countries in five years. What we don’t want to be is a one-trick pony,” Stephan said.

Whether or not more consumers will subscribe to KoverNow’s products, everyone will just have to wait and see.

Advertise

Advertise