What can blindside Australia’s growing general insurance industry

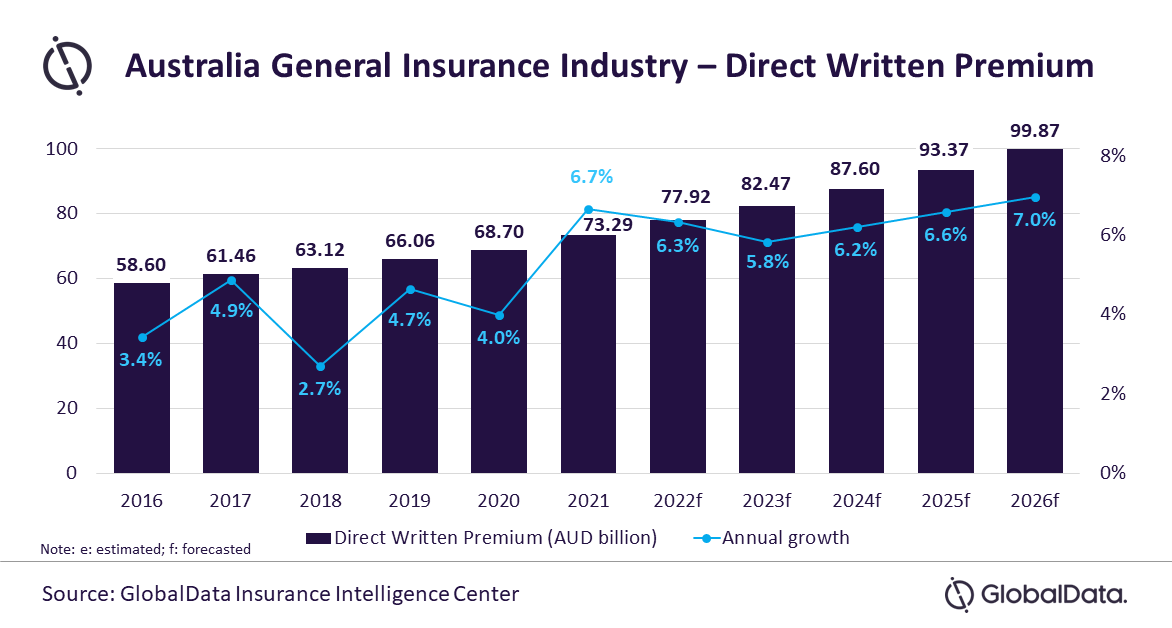

Natural catastrophe may hinder the potential CAGR of 6.4% through 2025, analysts warned.

Australia’s general insurance industry had a wonderful year of growth, albeit from a low base. In 2021, its profits were up by 281%, driven by the increase in gross written premiums (GWP) without a similar corresponding increase in claims costs. But according to KPMG, a looming threat in the form of climate change will potentially lead to a serious hike in premiums and make areas uninsurable.

The industry showing improved performance did not come as a surprise. GlobalData previously projected that the industry will grow from $54.6b in 2021 to $73.6b in 2026 in terms of direct written premiums. This is an estimated compound annual growth rate (CAGR) of 6.4% over five years from 2021.

“As this growth is partially driven by rate increases in some product classes, it demonstrates the continued hardening of the market,” KPMG explained, saying that the 2021 growth is the highest percentage movement it has seen in years. This is despite the tapering off of premium increases as a response to the pandemic in 2020.

Breaking down the performances of different segments of the general insurance market, personal accident and health (PA&H) insurance has now surpassed motor insurance as the largest segment in the market, accounting for 36.7% of the DWP in 2021. This is because PA&H insurance is mostly sold as riders or additional insurance not covered by the public health insurance system. The segment grew by 0.7% against its decline of 0.2% in 2020, supported mostly by an increase in premium rates by the government to counter rising medical costs.

Meanwhile, motor insurance is now the second-largest segment, which experienced a lull in 2020 and has been slowly inching up since 2021 as motor vehicle sales grew.

Hurdle to growth

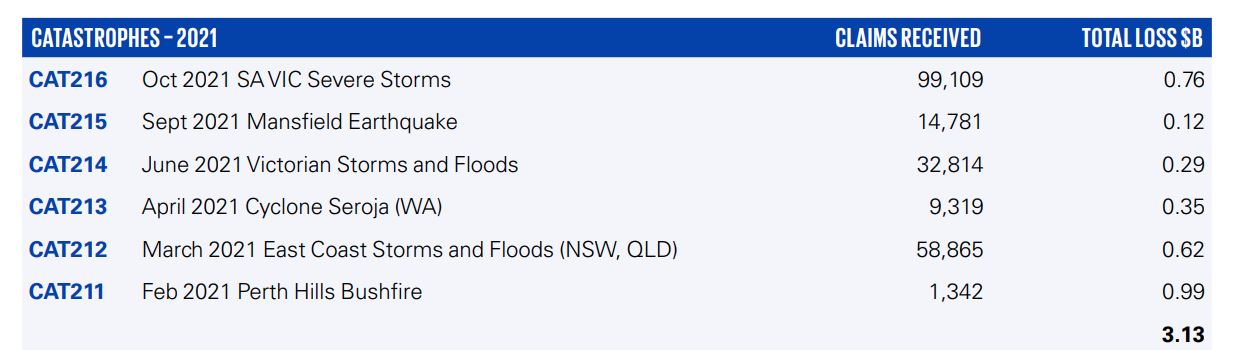

KPMG believes that continued growth in GWP, with ongoing rate increases, will continue. However, natural calamities will also continue to hamper growth. In March, the East Coast Flood event came at a significant cost to the industry with the Insurance Council of Australia reporting an estimate of $1.71b in claims costs.

“The industry is increasingly concerned that the frequency and severity of natural hazard events will significantly push premiums up and make some areas uninsurable,” KPMG said.

READ MORE: Climate risk is burning billions and Asia remains vulnerable

This just means that government intervention is a must. The industry alone may not be able to sustain insurance in flood-prone areas, KPMG warned. For instance, the government should implement flood mitigation measures.

However, the question remains: Is a reactive response enough?

Review and advisory body, The Productivity Commission, recently found that across Australia, 97% of natural funding is spent after an event, with just 3% spent on measures to improve community resilience.

“To create a more sustainable future for insurance, where insurance is affordable, the government will need to invest in mitigation measures to lessen the impact of these extreme weather events on communities,” KPMG added.

Insurers’ response

KPMG identified several key headwinds that insurers should consider in response to the threat natural calamities—such as floods, bushfires, and cyclones—will pose. First is that there is a significant change in the weather of spring and summer of 2021 to 2022 compared to 2019 to 2020, which saw Australia suffering from the worst bushfire season on record known as Black Summer.

This is the opposite of what will characterise 2022 as the weather is wet, frequented with bouts of torrential rain and hail events. The changes in weather patterns have been linked to the switch from El Niño to La Niña conditions.

With these factors, there is a threat of market failure and risk of underinsurance for some locations and classes of assets as natural perils become uninsurable.

ALSO READ: How Emma transforms AXA Mandiri's digital strategies

KPMG advised insurers to support industry initiatives. One example is the Climate Measurement Standards Initiative, which aims to provide consistent and comparable financial disclosure guidelines under the recommendations of the Task Force on Climate-related Financial Disclosures and support wider disclosure of climate change scenarios by the banking, insurance, and asset-owner sectors in Australia.

Insurers must also demand or develop better climate modelling to further improve their risk practices.

Finally, insurers themselves must spearhead customer education through the sharing of insight and analysis and develop new products that encourage customers to undertake mitigation plans and increase their climate reliance.

Advertise

Advertise