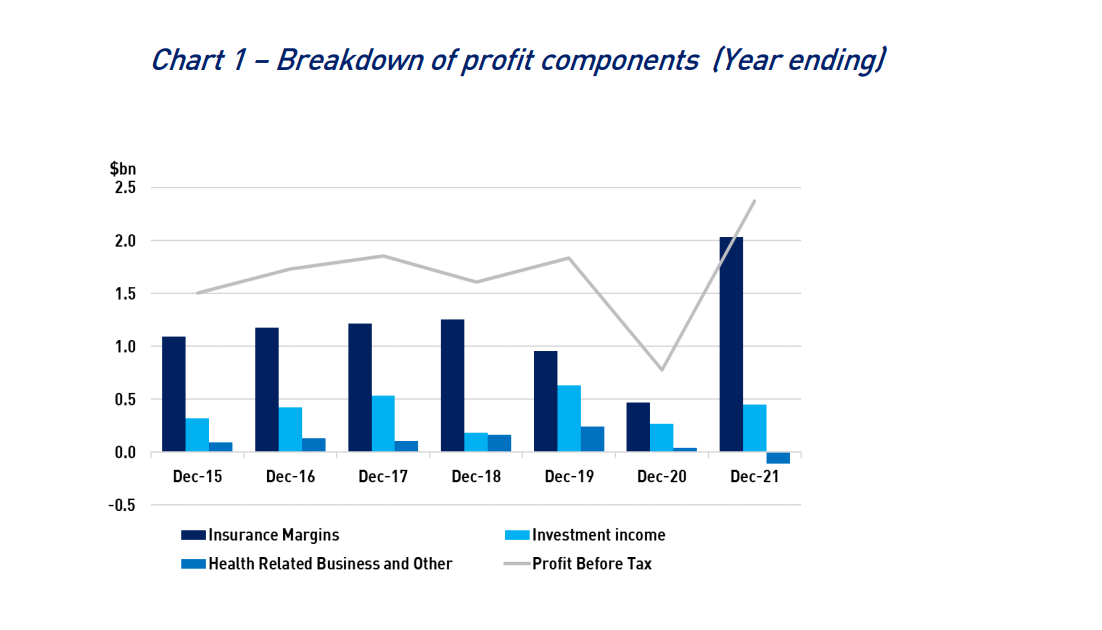

Australia private health insurers rallies in 2021 with 229.3% surge in profits

The increase was driven by insurance profits and investment income recovery.

Australian private health insurers saw a profitable year in 2021 as their net profits surged by 229.3% to AU$1.8b ($1.31b) from AU$558.8m ($405.90m) from the previous year, according to the latest statistics by the Australian Prudential Regulation Authority.

The increase in profitability for the year was driven mostly by the recovery in insurance profits and investment income following the weak margins and investment returns during the height of the pandemic in 2020.

Australian private health insurers yearly profits.

Premium revenue grew 5.8% over the year, from a combination of membership growth and premium rate increases. Claims also decreased slightly over the course of the year, due to various COVID-19 restrictions imposed across Australia and movements in insurers’ Deferred Claims Liabilities (DCL). As a result, gross and net margins increased in comparison to the prior year to 17.2% and 7.7%, respectively.

Meanwhile, management expenses increased 6.6% during the year, driven by increases in operational and administrative expenses. The industry also reported higher investment earnings in the year to December 2021, with a strong performance in equities investments being the primary driver.

Hospital treatment membership increased by 228,506 persons in 2021. Hospital coverage continued to increase during the year, taking total membership to 44.9% of the population, compared to 44.1% in 2020. This is a continuous growth trend over the past two years.

The longer-term ageing trend in hospital membership continued in the year to December 2021, with membership in the 50+ age group increasing by 119,425 persons whereas membership among the younger population (insured persons aged 20 to 49) increased by 61,372 persons.

For the fourth quarter (Q4) of 2021, private health insurance saw a decline in profits, driven by increased claims costs in the quarter resulting in lower gross and net margins than in the third quarter.

Premium revenue increased by 0.5% in Q4 2021 whilst fund benefits increased by 5.6%, driven mostly by a material increase in ancillary services as New South Wales and Victoria emerged from prolonged lockdowns. In response to the lockdowns and the suspension of elective surgeries, insurers added $211m of DCL in the December quarter 2021.

You may also like:

Great Eastern reports 33% decline in shareholder profits for Q4

Chinese insurer PICC P&C shrugs off sanctions on Russia

Surer backs new professional indemnity insurance in tripartite agreement

Advertise

Advertise