China's insurance premiums increase by 5.1% YoY

Year-to-date, the industry’s assets climbed 10.4%.

Total assets of Chinese insurance companies stood at RMB32.9t ($4.60t) in the first quarter (Q1 2024), a 10.4% increase from the beginning of the year, data from the National Financial Regulatory Administration (NFRA) showed.

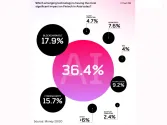

Property and casualty insurance assets reached RMB2.9t ($0.41t), up 4.4%; personal insurance assets were RMB28.6t ($4.00t), also up 4.4%; reinsurance assets totalled RMB775.1b ($108.52b), up 3.8%; and insurance asset management assets were RMB120.9b ($16.93b), up 14.9%.

During the same period, insurance companies recorded RMB2.2t ($0.31t) in primary insurance premium income, a 5.1% increase year-on-year (YoY).

Insurance claim and benefit payments reached RMB735.2b ($102.93b), a 47.8% increase YoY, with 20.6b new insurance policies issued, up by 30.1% YoY.

As of Q1 2024, the comprehensive solvency ratio of the insurance sector was 195.6%, and the core solvency ratio was 130.3%.

The comprehensive solvency ratios were 234.1%, 186.2%, and 264.4% for property and casualty insurance, personal insurance, and reinsurance companies, respectively, while the core solvency ratios were 206.3%, 113.5%, and 229.1%.

($1.00 = RMB7.25)

Advertise

Advertise