Hong Kong consumers are ‘moderately literate’ in insurance: study

But behavioural biases dragged the city's literacy score.

The insurance literacy of Hong Kong consumers is at 52%, implying that most are moderately literate when it comes to insurance, a study by the Hong Kong Insurance Authority found.

“There was a general understanding about policyholders’ rights, insurance principles and product features, but limited knowledge of risk exposure and protection needs,” the IA said.

Insurance literacy scores

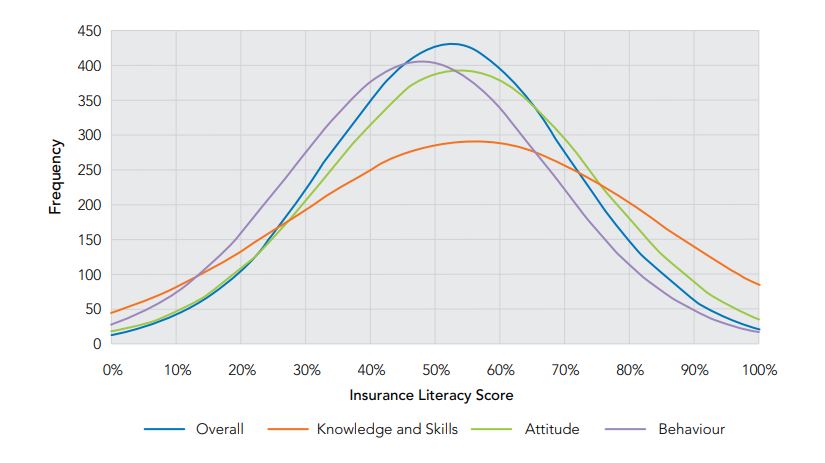

The report divided insurance literacy into three dimensions namely: knowledge and skills, attitude, and behaviour. Respondents scored 55%, 54% and 48% for each dimension indicating most are moderately literate in knowledge and skills as well as attitude.

Insurance Literacy Scores (Chart from Hong Kong Insurance Authority).

However, the survey found that respondents were slightly less literate in behaviour. This was because most consumers have behavioural biases such as 72% of respondents often relied on the advice and experience drawn from family members or friends when contemplating acquiring insurance.

Most consumers also seldom shop around for better insurance deals when purchasing or renewing insurance. Only 43% of respondents tended to make comparisons between different insurance products, whilst nearly half of the policy-holding respondents were influenced by promotion campaigns such as premium discounts, complimentary movie tickets and healthcare services offered by insurers. On the other hand, a mere 15% of general insurance policy-holding respondents reviewed renewal terms carefully and shopped around when they renewed their policies.

Only 32% of policy-holding respondents studied the fine print, like T&Cs, carefully and read them through before committing to acquire insurance coverage. 20% read neither policy details nor brochures. The rest simply focused on brochure information and verbal advice from agents, brokers, family members or friends.

Demographical factors

The IA also found that insurance literacy can be affected by demographical factors such as age, education, and income.

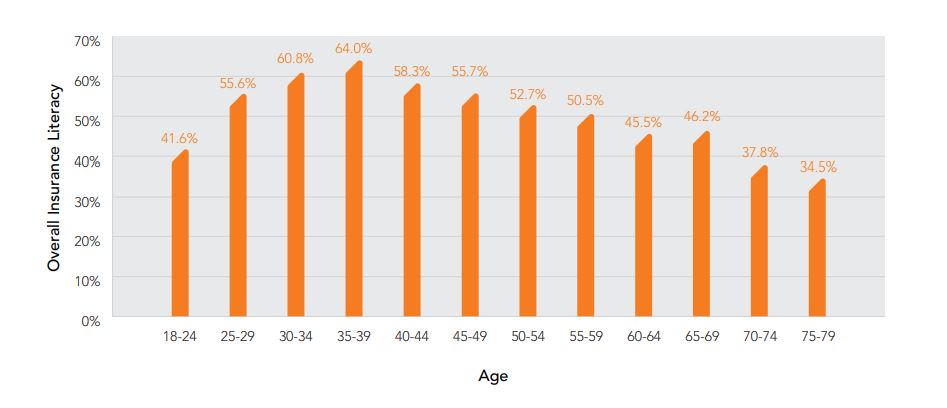

The youngest and the oldest have the lowest literacy scores. Those ages 18 to 24 has a literacy score of around 42% whilst those ages 60 to 79 score below 50%. In contrast are those people in their 30s who have insurance literacy scores of above 60%.

Insurance Literacy Level by Age (Chart from Hong Kong Insurance Authority).

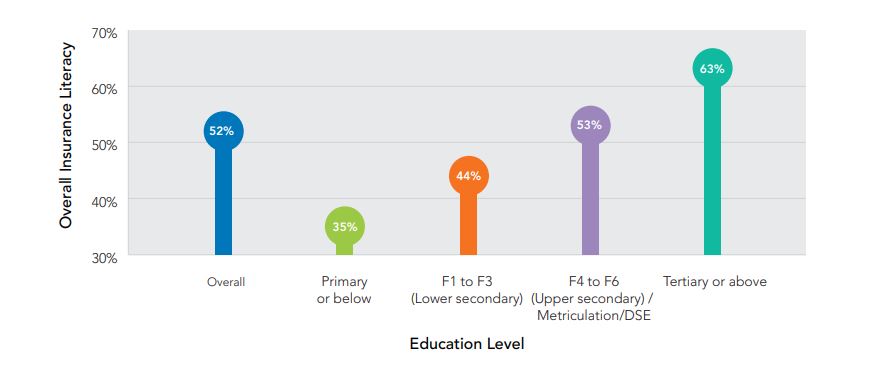

The report also found that insurance literacy is correlated to educational level. For respondents who graduated only from primary schools, their insurance literacy score was below 35% whilst those who graduated from tertiary education or above scored 63%.

Insurance Literacy Level by Education (Chart from Hong Kong Insurance Authority).

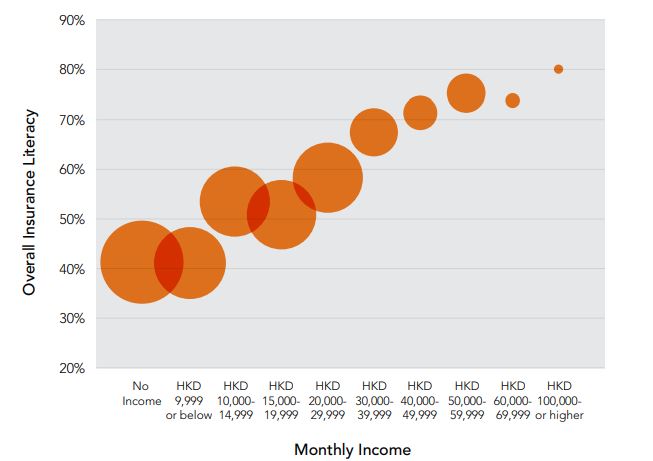

Income is also positively correlated to insurance literacy as the higher one's income is, the higher the literacy rate. The literacy score of respondents with a monthly income level below HK$10k is 41%, whilst those earning HK$100k or above score 80%.

Insurance Literacy Level by Income (Chart from Hong Kong Insurance Authority).

“The perceived value of insurance is quite high and the level of trust in the insurance sector is moderate, but insurance purchase was adversely affected by choice overload. Behavioural issues, such as over-reliance on the advice and experience of family or friends, procrastination in dealing with insurance, limited policy comparison, focus on promotions and inadequate reading of T&Cs, were identified,” the IA said.

Advertise

Advertise