Korea cracks down on third-party agent selling

The move will enhance transparency and reduce risk of mis-selling.

The Korean financial regulator has proposed to tighten rules governing general agencies (GAs) or third-party insurance agencies that cross-sell multiple insurers’ products, according to Moody’s Investors Service, who expects the move to enhance transparency in the sector.

Also read: Korean life insurers hit by short-term pain in shift towards protection products

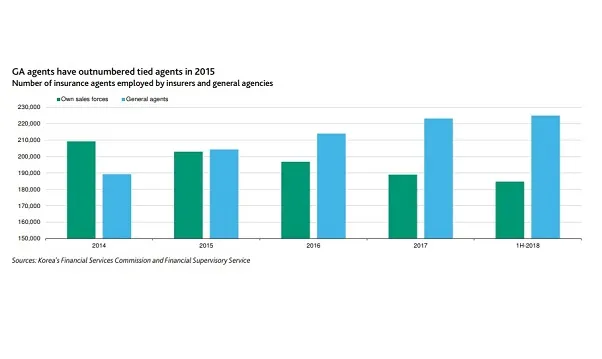

After experiencing strong growth in 2013, GAs have become one of the main distribution channel for Korean insurers and has since eclipsed the number of tied agents in 2015. Agents from insurance jobs were lured by prospects of GA’s high early-on commissions and the flexibility to sell multiple products. The number of GAs with more than 1,000 agents rose to 35 in the first half of 2018 from 24 in 2014.

With the rapid rise of GAs, however, came a higher number of policyholder complaints and mis-selling cases as users identified insufficient financial disclosure by agents and lack of transparency with the third-party agent selling.

Data from the Financial Supervisory Service (FSS) show that policies sold by GAs also have a surrender rate of more than 30% within two years of their sale, whilst the number of regulatory violations by GAs increased to 28 cases in 2018 from 15 in 2016.

The tighter internal control measures set by the FSS will therefore require GAs with more than 1,000 agents to establish an independent compliance division and establish minimum tenure for compliance officers of two years. Candidates seeking to become compliance officer will also face tougher hurdles as the required work experience is raised to 10 years from five.

Another prominent measure will come in the form of enhanced 12-hour training through mandatory group sessions that aim to prevent mis-selling. The sessions will focus on mis-selling disputes, criminal cases and consumer protection guidelines. Insurers and GAs will be required to report any regulatory violations and their agents' training completion rates on a regular basis, using a centralized public database

“If implemented successfully, the measures will not only help reduce the risk of mis-selling by GAs, but also increase the transparency and overall productivity of insurance agents,” analyst Young Kim at Moody’s Investors Service said in a report.

The measures are expected to be rolled out from H2 2019 to 2020.

Advertise

Advertise