Korean life insurers hit by short-term pain in shift towards protection products

Savings type products require higher capital charges and offer less attractive margins.

Korean life insurers were hit by large operating losses in 2018 partially due to their attempt to move away from savings type products and towards capital-intensive protection-type products to ensure a more stable income stream, according to Moody’s Investors Service.

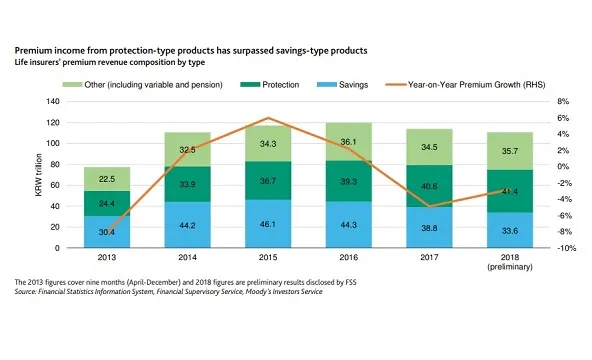

Although net profit of Korean life insurers rose 3.1% in 2018, premium income fell 2.8% amidst a 13.7% decline in premiums from savings-type products, data from the Financial Supervisory Services (FSS) show. On the other hand, premiums from protection-type products and variable/retirement pension products increased by 2.1% and 3.4% respectively.

“This extends the steady growth of protection-type and variable products in recent years and their weights in insurers' product mix. Premium income from protection-type products surpassed savings-type products in 2017,” analyst Young Kim said in a report.

Savings-type products require higher capital charges under the new regulatory regimes of IFRS 17 and K-ICS which will kick into effect by 2022. On the other hand, protection-type products are less vulnerable to interest-rate movements and economic cycles, and have better margins compared with savings-type products.

“The shift in product mix, driven by industry efforts to adopt profit-driven management strategies and tighten underwriting practice, will gradually improve insurers' mortality/ morbidity gains. Nevertheless, this product-mix transformation, together with subdued economic growth and low interest rates, will continue to weigh on insurers' profitability in 2019,” he added.

On the non-life insurance front, income declined in spite of a premium income growth of 3.1% amidst a higher incurred loss ratio for auto insurance. “We expect the auto loss ratio to stabilize with premium hikes of around 3.0%, as announced by a few non-life insurers, in 2019. On the other hand, premiums for long-term and general insurance increased by 3.0% and 6.3%, respectively,” concluded Kim.

Advertise

Advertise