LIC losing ground in India market share

Its competitors have projected double-digit growth from 2016 to 2020.

The Life Insurance Corporation of India is losing its market share in the highly concentrated Indian market, according to a report by GlobalData.

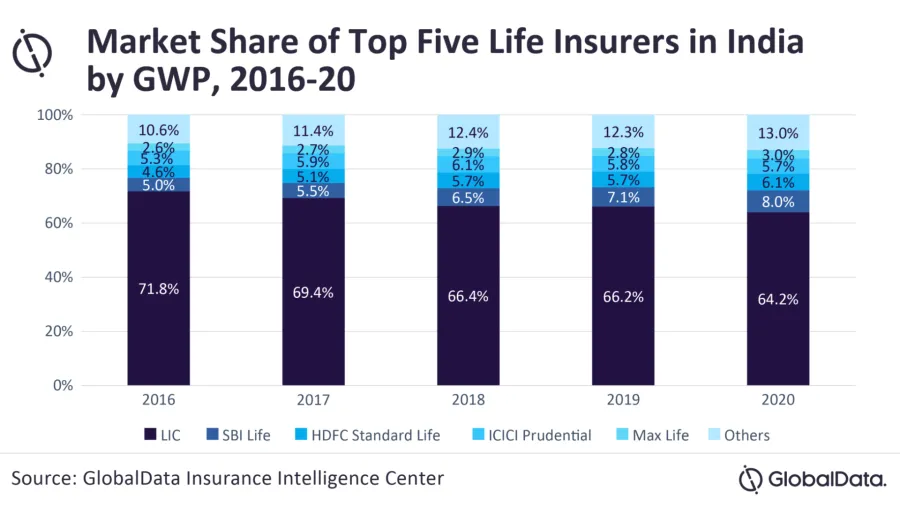

The life insurance market in India is highly concentrated with the top five insurers accounting for 87% of the share in 2020. Although LIC has continued to be the leading insurer in India, its market saw a significant drop from 71.8% in 2016 to 64.2% in 2020.

Meanwhile, its competitors are leap-frogging all over each other. SBI Life moved from being third in 2016 to the second-largest insurer in 2020. Similarly, HDFC Life became third-largest in 2020, moving up from its fourth position.

According to GlobalData’s Insurance Intelligence Center, the shifting positions of the top four life insurers are because they registered double-digit growths from 2016 to 2020 except LIC. The gross written premium of LIC grew at a CAGR of 7.6% during 2016-20, whereas SBI Life registered a growth of 24.4% followed by HDFC Life with 18.7%.

“LIC’s sales growth has slowed down during the last few years due to its high dependence on the traditional agency-led distribution model. Whereas private insurers have a more diversified distribution network,” Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, said.

In 2020, over 94% of LIC’s first-year premiums were generated through agents and insurance advisors, with banking and alternative channels such as corporate agents, brokers and insurance marketing firms (IMF) accounting for 3.4% and direct marketing at 2.2% share.

However, private insurers that are mostly backed by banks have increasingly adopted the bancassurance channel, which has allowed them to increase sales by leveraging their existing customers.

“LIC’s market share is expected to continue to decline due to its high dependence on traditional distribution channels and low technology investments as compared to private insurers. As LIC prepares for its IPO in 2022, the continuous decline in its market share could negatively impact investor sentiment,” Sahoo said.

You may also like:

Time for a comeback? Hong Kong’s top 50 insurers show a 9.75% surge in assets

Taiwan life insurance suffers 21.2% YoY drop in profit in February

Advertise

Advertise