Life, pension segment boosts growth for Malaysia’s insurance industry

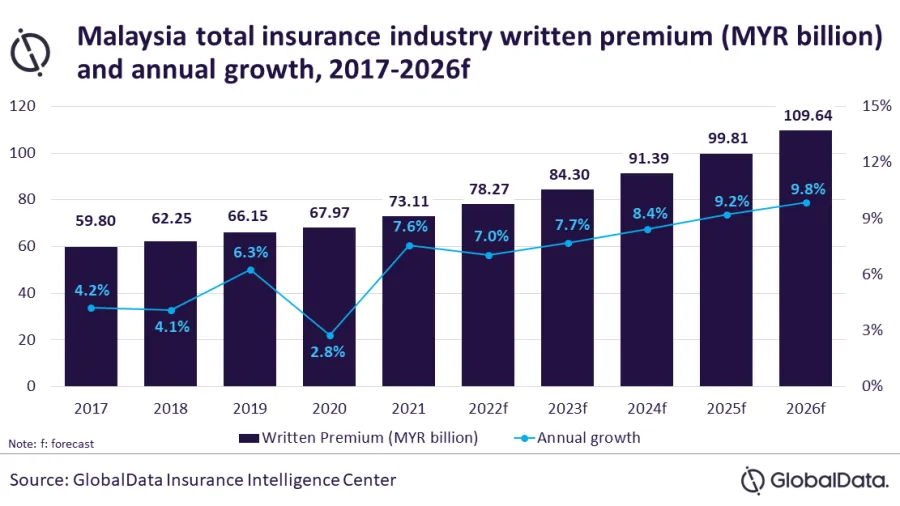

The industry is predicted to grow at a CAGR of 8.4% until 2026.

Life and pension segments will boost Malaysia’s insurance industry, leading to a compound annual growth rate (CAGR) of 8.4% from $17.6b in 2021 to $26.7b in 2026 in terms of written premiums, data and analytics firm GlobalData said.

Malaysia’s insurance industry grew by 7.6% in 2021 after declining by 2.8% in 2020 due to the COVID-19 pandemic-induced economic slowdown. The life insurance and pension segment accounted for 75.8% of written premiums in 2021. It is expected to grow at a CAGR of 9.5% from 2021 to 2026.

ALSO READ: Hong Kong consumers are ‘moderately literate’ in insurance: study

“The life insurance segment in Malaysia is dominated by endowment and unit-linked products, driven by better returns on these products as compared to bank deposits. To build on the popularity of these products and increase sales, many insurers offer attractive add-ons which include guaranteed annual cash payments, higher returns on maturity as well a higher sum assured in case of accidental death,” Sutirtha Dutta, Senior Insurance Analyst at GlobalData said.

General insurance accounted for the remaining 24.2% share of insurance premiums in 2021. The segment is expected to grow at a CAGR of 4.8% over 2021 to 2026, driven by an increase in vehicle sales and expansion of construction activities in the country.

Malaysia’s general insurance segment will also benefit from a boost in property insurance as, the construction sector grows by 11.5% in 2022, according to the Ministry of Finance.

“Increasing demand for life insurance products backed by growth in investment-linked policies and the inclusion of the lower income segment of the population in PT insurance policies will drive the growth of Malaysia’s insurance industry over the next five years,” Dutta said.

Advertise

Advertise