Philippines’ general insurance sector to grow 11.6% in premiums: GlobalData

This is equivalent to P211.5b ($3.7b) gross written premiums.

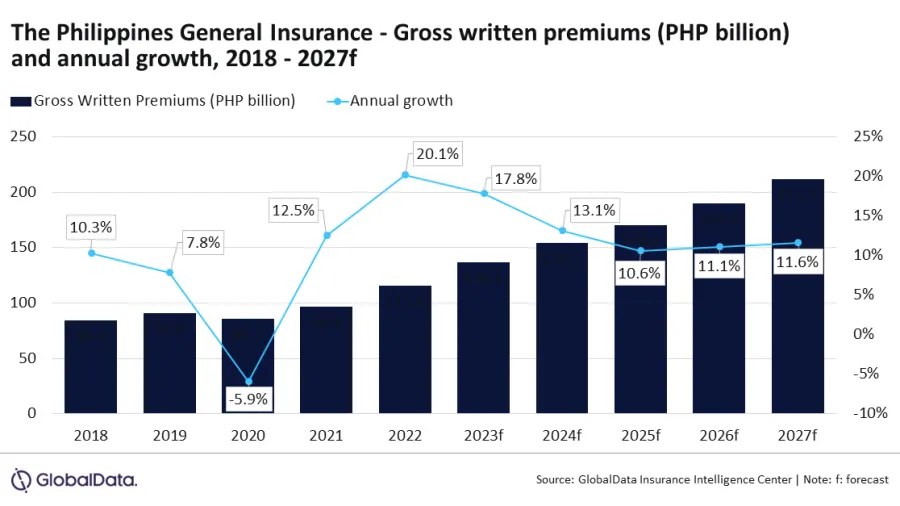

The general insurance industry in the Philippines is projected to experience a compound annual growth rate (CAGR) of 11.6% in 2027, according to GlobalData.

This would amount to P211.5b ($3.7 billion) in gross written premiums (GWP) in 2027, versus the expected P136.4b ($2.4b) in 2023.

GlobalData's Insurance Database indicates that the Philippines' general insurance sector is expected to grow by 17.8% in 2023.

This growth will be fueled by a robust economy, the construction of new infrastructure projects, and an increasing demand for natural catastrophic (nat-cat) insurance.

The country's sustained economic growth will positively impact key sectors such as automobile, construction, real estate, travel and tourism, as well as import and export activities, thereby driving the growth of the general insurance industry.

ALSO READ: Philippine micro-insurance premiums rise 14% in 2022

GlobalData also predicts the country's real gross domestic product (GDP) growth to be approximately 5.5% in 2023 and 5.6% in 2024.

“Property insurance is the leading line in the Philippines general insurance market, which is estimated to account for 36.8% share of the GWP in 2023. It is forecast to grow by 15.9% in 2023, supported by the increasing demand for nat-cat insurance policies as the Philippines is prone to typhoons and earthquakes.” Manogna Vangari, Insurance Analyst at GlobalData said.

Advertise

Advertise