Thailand’s general insurance market to generate $11b by 2027 – GlobalData

Motor insurance accounts for 54.8% of the GWP in 2022, and is expected to grow by 5.6% in 2023.

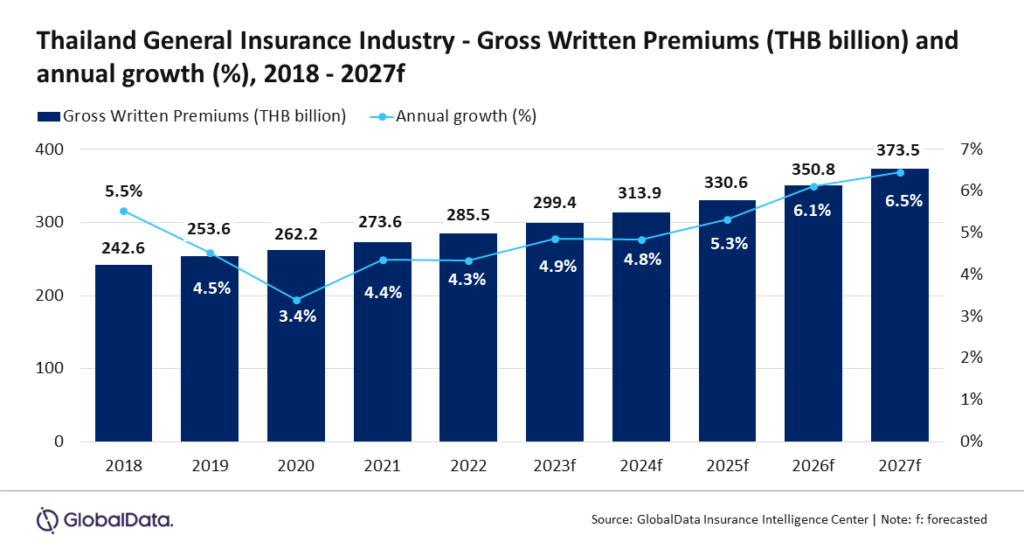

The general insurance industry in Thailand is anticipated to experience a compound annual growth rate (CAGR) of 5.7%, rising from $8.1b in 2023 to $11b in 2027 in terms of gross written premiums (GWP), according to GlobalData.

“However, with a recovery that started in 2021, the industry is expected to surpass its pre-pandemic growth level in 2023. It is expected to reach a full recovery by 2025, supported by property and motor insurance, which will be the fastest growing general insurance lines in 2023,” Sneha Verma, Insurance Analyst at GlobalData said.

/GlobalData

The projection is based on a recovery in vehicle sales, government infrastructure projects, and increased demand for natural catastrophic (nat-cat) insurance.

Motor insurance, accounting for 54.8% of the GWP in 2022, is expected to grow by 5.6% in 2023, driven by rising motor vehicle sales and government initiatives to enhance motor insurance awareness.

ALSO READ: Miller makes a mark in Thailand’s energy sector

Personal accident and health insurance, the second-largest line, is forecast to grow at a slower CAGR of 1.4% due to changes in co-payment regulations.

Property insurance, accounting for 16.8% of the GWP in 2022, is expected to grow by 9.5% in 2023, supported by major construction projects and an increase in the frequency of natural catastrophe events.

The remaining 10.4% of the general insurance GWP in 2023 is expected to come from liability, financial lines, marine, aviation, and transit (MAT), and miscellaneous insurance.

“Additionally, the government is taking initiatives to increase motor insurance awareness and ensure that all vehicles have compulsory motor insurance,” Verma said.

“On April 21, 2023, the Office of Insurance Commission (OIC) and the Department of Land Transport jointly launched a digital data-linking system to verify compulsory motor insurance policies at the time of paying vehicle tax annually. The new system will increase compliance and support motor insurance growth in Thailand.” she added.

Advertise

Advertise