What will drive India’s general insurance sector this year?

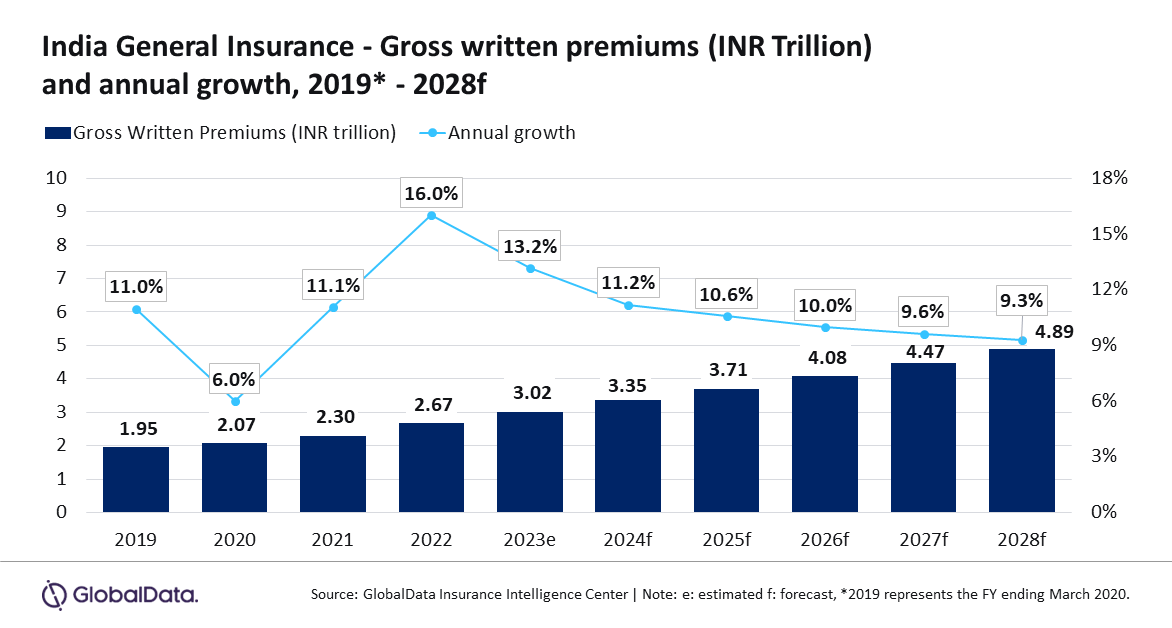

The industry is slated to grow by 11.2% this year.

India’s general insurance industry is projected to expand at a compound annual growth rate (CAGR) of 9.9%, increasing from $40.4b in 2024 to $57.3b by 2028, according to GlobalData.

“The general insurance industry in India continued its high growth trend and grew by 13.2% in 2023, driven by economic growth and rising disposable income. Rising consumer awareness of health and other general insurance products and robust regulatory reforms also supported India’s general insurance industry growth. The trend is expected to continue in 2024 and 2025,” Swetansha Chauhan, Insurance Analyst at GlobalData, said.

In fiscal year 2024, the industry is expected to grow by 11.2%, driven by personal accident and health (PA&H), motor, and property insurance, which together accounted for 93% of general insurance premiums in 2023.

PA&H insurance is anticipated to be the largest segment, representing 39.5% of general insurance gross written premiums (GWP) in 2024. It is projected to grow by 14.5% in 2024, fueled by heightened health awareness and rising medical costs post-COVID-19. The PA&H segment is forecasted to grow at a CAGR of 12.5% from 2024 to 2028.

Supportive regulatory measures are expected to further bolster PA&H insurance. In December 2023, the Indian government proposed the establishment of a healthcare regulator to standardise and regulate hospitals involved in health insurance, aiming to enhance health insurance penetration.

The Insurance Regulatory and Development Authority of India (IRDAI) also introduced the ‘Bima Sugam’ electronic marketplace in March, intended to streamline the purchase, sale, servicing, and claim settlement of insurance policies, promoting transparency and efficiency in the insurance sector.

Motor insurance, the second largest segment, is projected to account for 31.1% of general insurance GWP in 2024, with a growth rate of 10.4%. This growth is supported by rising vehicle sales, which increased by 12.5% in March compared to the previous year, and a boost in disposable income.

The government’s vehicle scrapping policy implemented last 1 April 2023 also drove this market, Chauhan added. The policy itself requires private automobiles beyond 20 years old whilst commercial vehicles over 15 years old to be scrapped.

“Motor insurance is expected to grow at a CAGR of 7.9% from 2024 to 2028,” Chauhan said.

Property insurance, the third largest segment, is expected to hold a 22.5% share of general insurance GWP in 2024, with a growth forecast of 10.4%.

The sector benefits from increased infrastructure investments, with the government’s budget allocation for infrastructure rising by 11.1% year-on-year to $134b for 2024 to 2025. Property insurance is projected to grow at a CAGR of 8.3% through 2028.

Liability, Marine, Aviation, and Transit (MAT) insurance, along with other general insurance products, is expected to make up the remaining 6.8% of general insurance GWP in 2024.

“Recovery in the economy and rising disposable income will continue to support the growth of India’s general insurance industry during the next five years. Initiatives from the government and favourable regulatory reforms will help in increasing the insurance penetration rate in India (0.98%), which was lower as compared to other Asian markets such as Japan (1.75%), South Korea (1.46%), Hong Kong (1.65%) and China (1.26%) in 2023,” concluded Chauhan.

Advertise

Advertise