What will drive Japan’s insurance sector to surpass $470b by 2029?

Premium increases in life and general insurance will boost the industry this year.

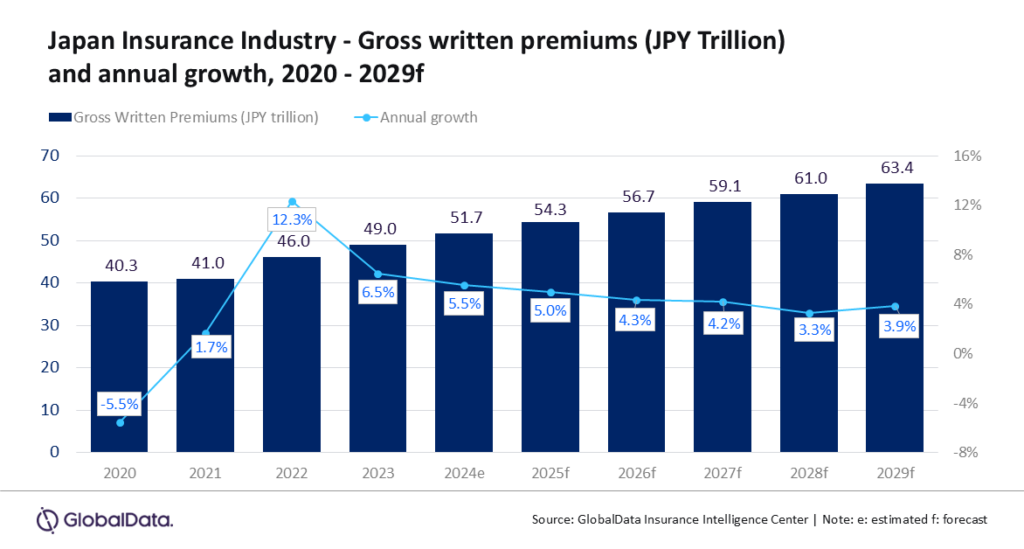

Japan’s insurance sector is slated to go over $470b in four years, registering a compound annual growth rate (CAGR) of 3.9% from 2025 to 2029, according to GlobalData.

Life insurance made up 77.4% of Japan’s total insurance premiums in 2024, whilst general insurance accounted for the remaining 22.6%.

GlobalData attributes the projected growth to demographic and regulatory changes, as well as increased demand for coverage against natural catastrophes and cyber risks.

The country’s economy is forecast to contract by 0.9% in 2024, following a 1.9% expansion in 2023, Swarup Kumar Sahoo, senior Insurance analyst at GlobalData, said in the research note.

Despite the expected slowdown, GlobalData says that a recovery in economic activity, growing demand for yen-denominated products, and premium increases in both life and general insurance segments will support industry growth in 2025.

Japan’s life insurance segment is projected to grow by 5.9% in 2025. Demand is being driven by an ageing population and rising life expectancy.

People aged 65 and above made up 29.3% of the population in 2024, a figure expected to rise to 34.8% by 2040, according to the National Institute of Population and Social Security Research.

Regulatory changes have also played a role. In January 2024, the Financial Services Agency moved to restrict the sale of foreign-currency-denominated insurance products, prompting a shift back to yen-based offerings.

Life insurance is expected to grow at a CAGR of 4.4% from 2024 to 2029.

The general insurance segment is projected to grow at a CAGR of 2.2% over the same period.

Growth is supported by rising premium rates, increased demand for nat-cat coverage, and higher uptake of liability insurance.

However, the general insurance sector’s expansion is likely to be tempered by slower growth in motor insurance, which represents nearly half of the segment’s premiums.

Sahoo further notes that the rising frequency and severity of extreme weather events in recent years have led to higher claims, prompting insurers to reassess risk exposure and raise premium rates.

Since 2020, the General Insurance Rating Organisation of Japan has regularly increased the nationwide average reference net rate used to guide personal fire insurance premiums, reflecting higher insurance payouts and repair costs.

Amongst general insurance lines, liability insurance is expected to see the highest growth in 2025, supported by rising demand for cyber insurance and workmen compensation policies.

Advertise

Advertise