Australian pension funds turn to catastrophe bonds for higher returns

Australia’s pensions industry brings over A$2b inflows weekly.

Australia’s leading pension funds are increasingly looking to natural catastrophe reinsurance as a strategy to enhance returns amidst the growing number of natural disasters, as reported by Bloomberg.

Colonial First State, one of the country’s largest pension and wealth managers, is considering adding catastrophe reinsurance to its A$151b ($99.66b) portfolio.

This move follows Insignia Financial Ltd.’s success in the sector, which posted a 16% return in the last financial year.

With Australia’s pensions industry expanding, bringing in over A$2b ($1.32b) in inflows weekly, funds are under pressure to find new investment opportunities.

Natural catastrophe reinsurance, which includes financial products like catastrophe bonds, offers such an opportunity.

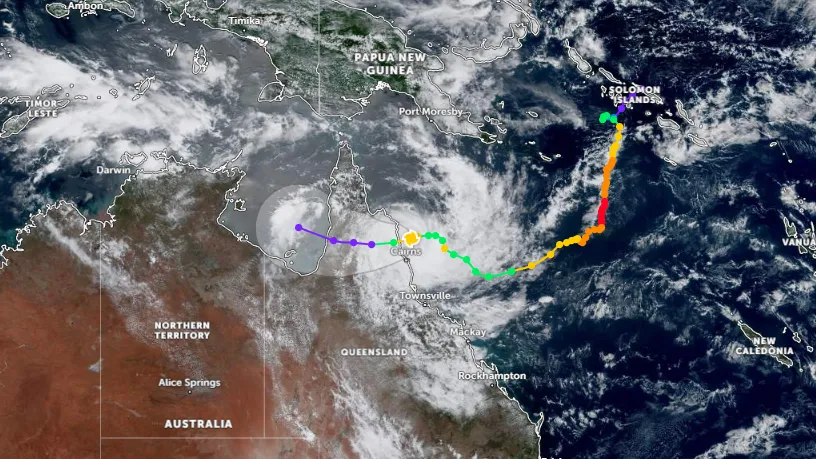

These bonds provide high returns in exchange for the risk associated with natural disasters like hurricanes and earthquakes. Bondholders are rewarded if no catastrophe occurs but must pay out if one does.

The market for catastrophe bonds is expanding, with issuance hitting record levels in June 2024 as the industry braces for a severe hurricane season. Sales of these bonds increased by 38% through May compared to the same period in 2023, reflecting heightened concern over extreme weather events.

Natural catastrophes caused about $62b in insured losses in the first half of 2024, significantly above the 10-year average. Armitage sees this as a promising area for capital allocation, predicting that as natural disasters become more frequent, demand for capital to support these policies will increase.

Australia’s pension funds, which manage A$3.9 trillion ($2.57 trillion) in assets, are under intense scrutiny for their investment performance.

With compulsory contributions set to rise to 12% of workers’ salaries next year, these funds are seeking uncorrelated and high-return investments to diversify their portfolios.

Insignia Financial, which manages A$180b ($118.8b) in retirement savings, has been actively investing in catastrophe bonds, quota shares, and collateralised reinsurance contracts.

These investments, which make up 15-20% of Insignia’s exposure to natural catastrophe reinsurance, have yielded strong returns.

Farmer highlighted the appeal of reinsurance investments due to their low correlation with the rest of the portfolio.

The increasing interest in catastrophe bonds has also attracted fund managers to Australia, seeking to raise capital.

Martin Rea, a senior consultant at JANA, which advises institutional investors including pension funds, noted that with current spreads elevated, many clients are expanding their holdings in catastrophe bonds or bringing in new managers.

Whilst Rea holds a positive medium-term view of the catastrophe bond market, he expressed caution over the next three to six months due to forecasts of higher-than-normal hurricane activity.

He also pointed out that whilst the market has seen 19 months without a negative return, this trend is unlikely to be sustainable.

($1.00 = A$1.52)

Advertise

Advertise