Australia’s historic natural disasters would lead to bigger financial costs today – ICA

The council urges for better investment in resilience and mitigation measures.

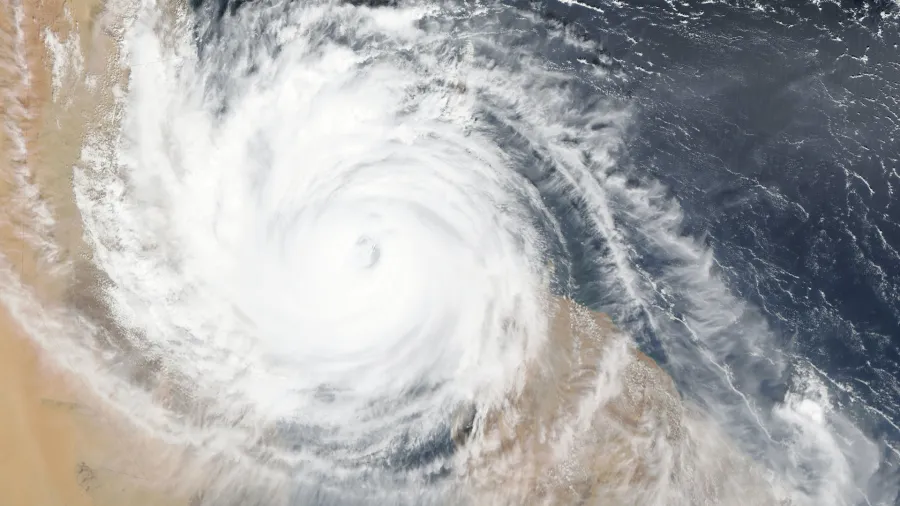

Costs associated with historical natural disasters in Australia, such as the 1999 Sydney Hailstorm and Cyclone Tracy, would surpass even last year's record-breaking floods if they occurred today, recent data from the Insurance Council of Australia (ICA) showed.

The 1999 Sydney Hailstorm, which led to AU$1.7b in insured losses, would now result in an estimated AU$8.85b in insured losses if it occurred in 2023.

Cyclone Tracy, responsible for 71 casualties and AU$200m in insured losses in 1974, would cause an estimated AU$7.4b in insured losses in 2023.

The 2022 South-East Queensland and New South Wales Floods, which incurred AU$6b in insured losses, remain the most expensive extreme weather event in Australia's history.

The data, provided by Risk Frontiers, accounts for factors such as inflation, changes in property numbers and values, and stricter building codes. It helps insurers, reinsurers, governments, and policymakers anticipate the potential impact of future extreme weather events.

ALSO READ: Australian insurers’ ‘cyclical’ profits often affected by uncontrollable entities – ICA

The increase in estimated insured losses for historical events underscores the need for increased investment in measures to enhance the resilience of communities at risk from extreme weather events.

This data is featured in the Insurance Council of Australia's annual Insurance Catastrophe Resilience Report. The report addresses the foremost issue facing the Australian insurance industry and its customers – affordability and availability.

The ICA advocates for greater investment in resilience and mitigation measures, ending development on floodplains, expanding home buy-back schemes to relocate people from high-risk areas, improving building codes for increased resilience, and reforming state taxes on insurance products to provide immediate cost relief.

Advertise

Advertise