Automobile sales recovery to boost China’s general insurance market

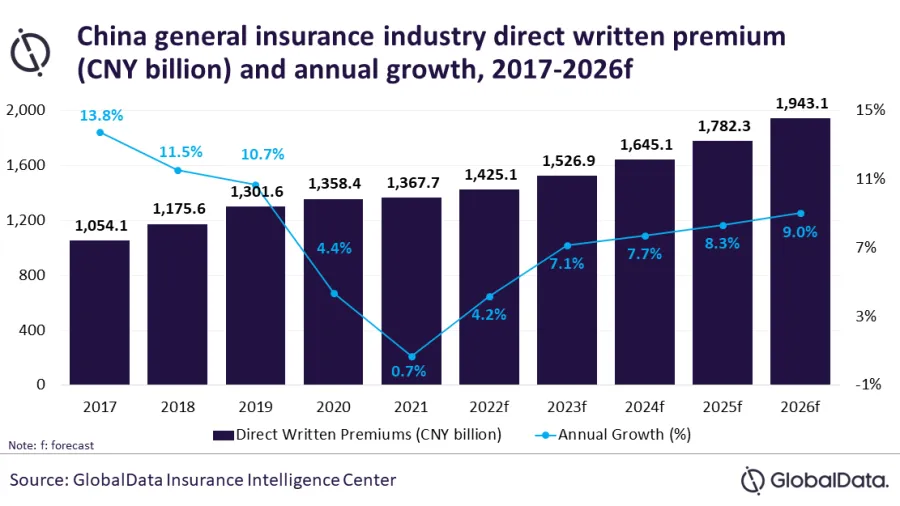

The market is expected to grow at CAGR of 7.2%.

Sales of motor insurance will drive China’s general insurance industry’s growth to reach $304.4b in 2026, GlobalData reveals.

According to the data and analytics firm, the Chinese general insurance market is set to grow at a compound annual growth rate (CAGR) of 7.2% from CNY1,367.7b ($212.1b) in 2021 to CNY1,943.1b ($304.4b) in 2026, in terms of direct written premiums (DWP).

The industry is expected to recover in 2022 and continue its growth trend over the next five years after registering a low growth of 0.7% in 2021 due to a decline in motor insurance as supply chain disruptions and stringent lockdowns in the major manufacturing hubs of Shanghai and Changchun led to a fall in vehicle sales.

ALSO READ: How GIA plans to solve the SMEs' underprotection against cyber threats

However, the motor insurance segment is expected to recover from 2023 as automobile sales are expected to improve due to the proposed extension of subsidy for electric vehicles till 2023. Electric vehicles constituted nearly 20% of total vehicles sold in China in 2021. Motor insurance was the largest line within the Chinese general insurance market, accounting for a 56.8% share in terms of DWP in 2021.

“The expected increase in the sales of electric and hybrid vehicles, which have 20% higher premiums compared to internal combustion engine vehicles, will help the motor insurance segment to recover from 2023 to grow at a CAGR of 2.4% over 2021-26,” Shabbir Ansari, Senior Insurance Analyst at GlobalData said.

Meanwhile, Personal Accident and Health (PA&H) insurance was the second largest general insurance line in China, accounting for a 14.7% share in terms of DWP in 2021. PA&H insurance is expected to continue its double-digit growth over the forecast period, driven by raising awareness over protection and financial planning due to recurring COVID-19 waves.

Property insurance was the third-largest line, accounting for a 12.7% share of general insurance premiums in China in 2021. Property insurance is expected to grow at a CAGR of 12.4% from 2021 to 2026, driven by the Chinese government’s plans to invest more than $1t in infrastructure projects, including high-speed rail networks, renewable energy projects, and water tunnels, which are expected to be completed by 2030, will boost property insurance.

Liability, Financial Lines, Marine, aviation and transit (MAT), and Miscellaneous insurance accounted for the remaining 15.8% share in 2021.

“The expected recovery in automobile sales, growing health awareness and increased investments in infrastructure projects will support general insurance growth in China. However, rising inflation will increase the cost of claims impacting profit margins of insurers,” Ansari said.

Advertise

Advertise