China’s regulator calls insurers to make haste for recent flood-affected areas

Chinese insurers have received a total of 117,600 claims.

The National Financial Regulatory Administration (NFRA) directed insurance institutions to improve services for flood-affected members.

The NFRA specifically said that Chinese insurers must provide efficient services, emphasising accurate predictions, robust preparations, effective communication, streamlined procedures, prompt payments, and specialised assistance amidst the recent flooding.

Recent extreme rainfall in regions including Hebei, Beijing, Heilongjiang, Jilin, and Tianjin has led to floods and geological disasters.

The NFRA reported that China's insurance institutions have received numerous claims from affected individuals.

As of August 8 at 10A.M.., these institutions in the five areas have received a total of 117,600 claims.

ALSO READ: China Life Insurance (Overseas) to stay afloat in the next two years: S&P Global

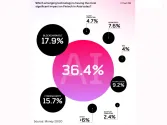

The claims are primarily related to automobiles, enterprise property, and agricultural insurance.

The cumulative losses outlined in these claims amount to approximately $750m, as reported by the administration.

Among these claims, insurance institutions have already settled 22,600, resulting in a total payout of about $26m.

Advertise

Advertise