Cyber insurance costs drop amidst improved cyber hygiene

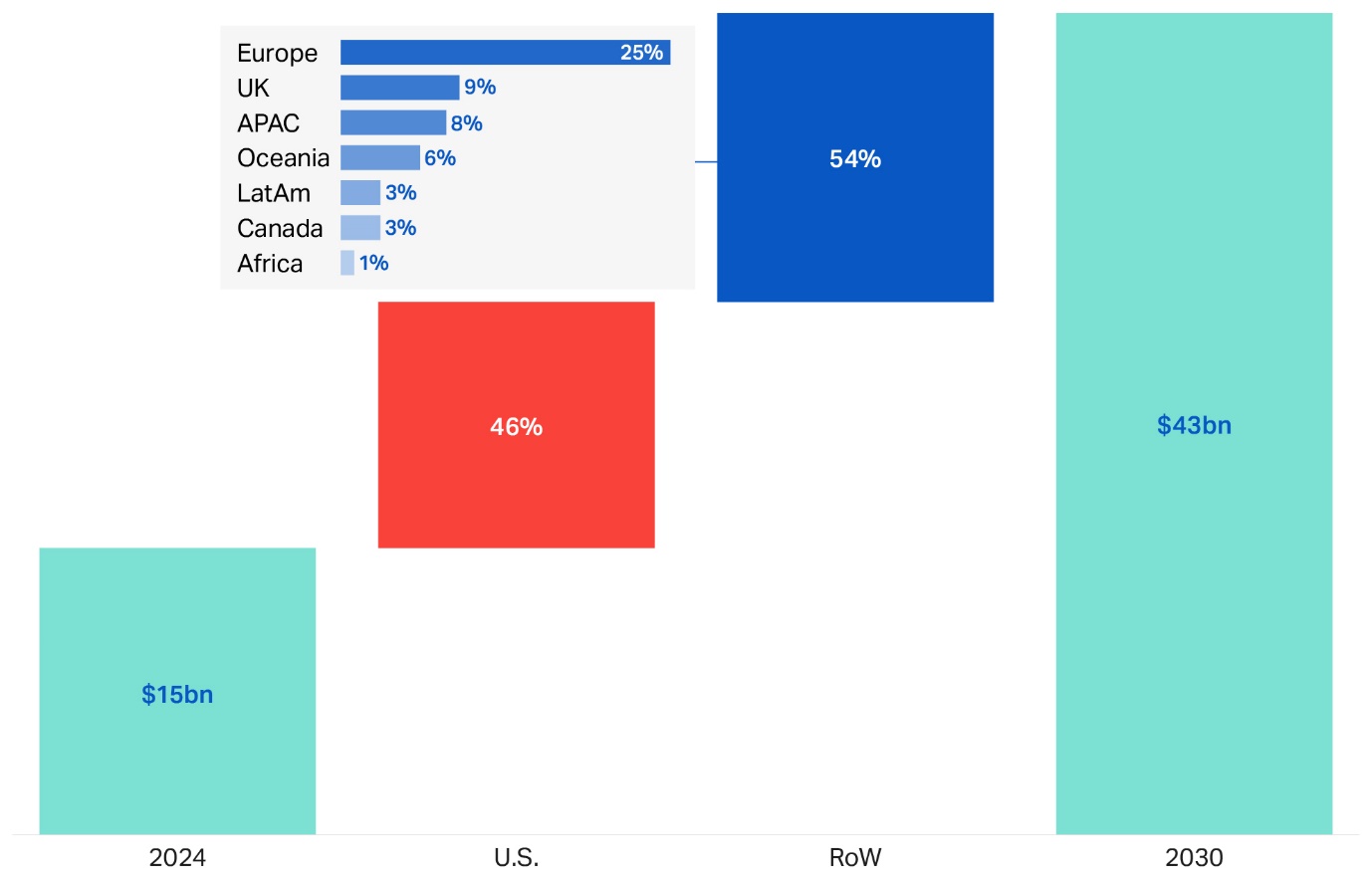

Global cyber insurance to hit $43b by 2030, Howden projects.

Despite ongoing cyber threats, geopolitical instability, and advancements in artificial intelligence (Gen AI), the cost of cyber insurance continues to decrease. This stability is attributed to improved cyber hygiene among insureds, which has helped mitigate the impact of cyber attacks, Howden unveiled.

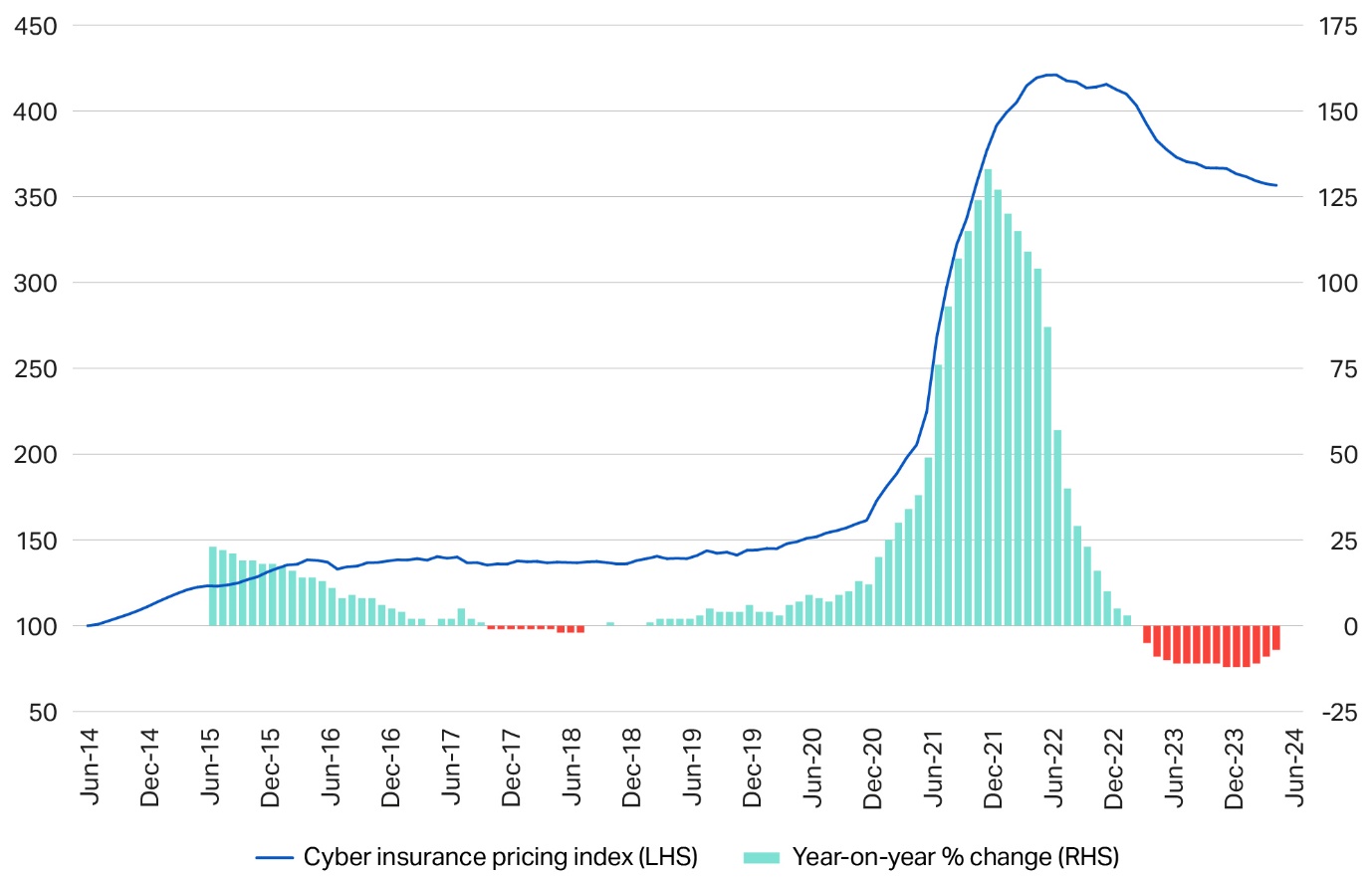

Howden's Global Cyber Insurance Pricing Index, as depicted in Figure 1 of their fourth annual cyber report titled "Risk, Resilience and Relevance”, illustrates this declining trend in cyber insurance premiums.

Figure 1. Source: Howden

“Carriers and brokers have made significant progress in the past few years of enhancing price stability, coverage clarity and the consistency of terms and conditions. Against this backdrop, the market now has two stand-out opportunities to achieve Howden’s global premium projection of $43b by 2030: significant expansion beyond the U.S. and serving a broader client base amongst SMEs,” the report noted.

Looking ahead, Jean Bayon de La Tour, Head of Cyber, International, emphasises the potential for global expansion in cyber insurance.

“This involves providing more capacity to meet pent-up demand in currently underpenetrated regions, including Europe, Latin America and Asia, areas where Howden is investing strongly. The potential for growth is huge, particularly as most of these countries are coming off such a low base,” de La Tour said in a media release.

Europe is pegged to have the largest share in cyber premiums growth in the 2024 to 2030 period, with 25%. This was followed by the UK (9%) and Asia Pacific (8%).

Figure 2. Source: Howden

Moreover, the SME sector presents a substantial opportunity for growth in cyber insurance.

With nearly half of GDP in advanced economies attributed to SMEs, there is a significant need to enhance their access to cyber insurance.

Advertise

Advertise