Half of Indians risk financial strain by selecting insufficient health coverage

51% incorrectly believe that critical illness treatments cost less than Rs5 lakh.

Nearly half of policyholders opt for health insurance coverage of $5,856 (Rs5 lakh) or under, underestimating the actual cost of medical treatments, according to Policybazaar.

In its second edition, the report "How India Buys Insurance 2.0." further showed that in South India, 66% of policyholders have coverage limited to Rs5 lakh or below.

Amongst non-policyholders, 51% incorrectly believe that critical illness treatments cost less than Rs5 lakh.

Health insurance has emerged as one of the top three financial products for 28.3% of respondents, surpassing equities, mutual funds, and government bonds.

However, traditional investments such as gold, fixed deposits, and real estate remain the most preferred options.

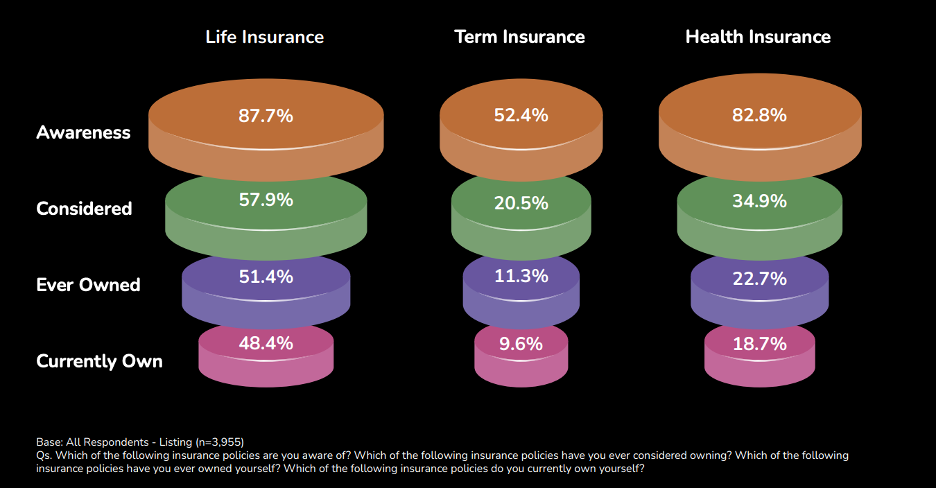

The report also finds that 47.6% of Indians are unaware of term insurance and its benefits.

Whilst awareness remains low, industry data shows an 18% growth in term insurance adoption in fiscal year 2024, compared to a 2% CAGR over the previous five years.

Of those aware of term insurance, 56% express a positive attitude toward purchasing it.

A significant gap persists in understanding family financial needs. The survey shows that 87% of non-buyers of term insurance underestimate the financial support their families would require in their absence.

Only 13% of non-buyers estimate their insurance needs according to expert recommendations, which suggest life insurance coverage of 15 to 20 times the individual’s annual income.

Sarbvir Singh, Joint Group CEO of PB Fintech, said the report highlights an ongoing lack of consumer awareness.

He noted that many individuals prefer selling ancestral assets or borrowing money during crises instead of using insurance products to protect their families.

($1.00 = Rs85.40)

Advertise

Advertise