Indonesia life premiums fall 1.1% in 9M 2025 despite coverage jump

Insured lives climbed 12.8% to 151.56 million by September 2025.

Indonesia’s life insurance industry recorded steady growth in coverage and income in the first nine months of 2025, despite a slight decline in premiums, according to the Indonesian Life Insurance Association (AAJI).

AAJI data from 56 life insurers showed the number of insured persons reached 151.56 million as of September 2025, up 12.8% year on year.

AAJI chairman Budi Tampubolon said the increase reflects rising public awareness of the need for long-term financial protection.

Both individual and group segments expanded. Individual policyholders rose 16.9% to 22.32 million, whilst group insured lives increased 12.1% to 129.25 million.

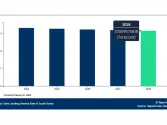

Total industry income grew 3.2% to $10.28b (Rp174.21t) in January–September 2025.

Premium income, however, edged down 1.1% to $7.86b (Rp133.22t) due to a fall in single-premium sales as household purchasing power continued to recover.

Budi said regular premiums remained resilient, rising 5% to $4.90b (Rp83.04t), indicating that consumers are shifting towards more affordable periodic payment products.

He added that life insurance continues to support household financial resilience amidst global and domestic economic pressures.

($1.00 = Rp16,827.40)

Advertise

Advertise