Insurers face China AI surge as report ranks disruption as top threat

Regulation change sits third with 33% citing it as a major risk driver for companies.

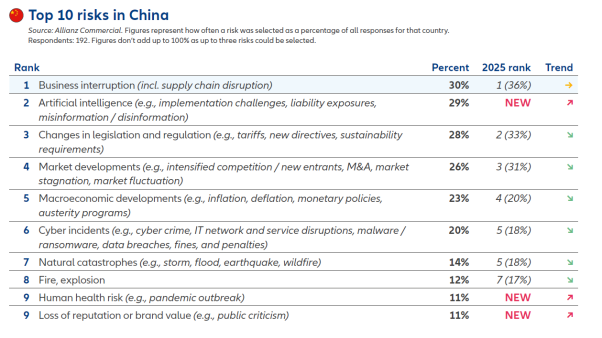

Business interruption is the primary concern for most companies in China for 2026 that insurers must be on the lookout for, according to the Allianz Risk Barometer report.

This risk, which includes supply chain disruption, is closely followed by the rapid rise of artificial intelligence (AI), which now ranks as the second-highest concern in the country.

Changes in legislation and regulation rank third, with 33% of respondents citing it as a major factor, whilst market developments and macroeconomic shifts complete the top five.

Globally and across the Asia-Pacific region, the risk landscape is dominated by cyber incidents, AI, and business interruption.

AI has seen the most significant jump in ranking this year, rising from 10th place in 2025 to second place globally in 2026.

This shift highlights a growing recognition of AI as a complex source of operational, legal, and reputational challenges as its adoption accelerates across all industry sectors.

In China, business interruption concerns are heavily influenced by geopolitical shifts and growing protectionism, which has led to a tripling of trade restrictions affecting an estimated $2.7t in merchandise.

Benson Peng, Country Head of Allianz Commercial China, highlighted that intense competition and AI readiness are also critical factors.

China’s "AI Plus" initiative aims to integrate intelligent terminals into 90% of key sectors by 2030, further cementing the role of technology in the local risk landscape.

Advertise

Advertise