Japan's major non-life insurers set to weather earthquake losses, strong capital buffers to cushion impact

AM Best said the major non-life insurers carry diversified portfolios and strong capital positions.

The recent earthquake which hit Japan's west coast on 1 January, impacted non-peak zones in terms of insurance exposure accumulation. While it's too early to estimate insurance losses, AM Best anticipates limited credit rating impact on major domestic non-life insurers due to robust capital buffers.

Government-backed reinsurance should mitigate residential losses. Earnings impact on insurers is expected to be manageable, offset by underwriting profit from voluntary automobile lines. Potential effects on proportional reinsurance treaty performance might lead to upward price pressure at 1 April Japan reinsurance renewals.

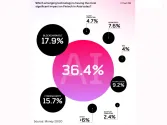

Japan's four major non-life insurers (Tokio Marine, Sompo Japan, Mitsui Sumitomo, and Aioi Nissay Dowa) with diversified profiles and strong capital positions are expected to handle losses well. Their aggregate net assets exceed $48.6b as of 31 March 2023.

ALSO READ: Japan earthquake could reach $1.8b insured losses – Verisk

The Japanese government's support for earthquake risks, especially residential ones, and insurers' conservative reinsurance strategies should minimise losses. Commercial and industrial risks, Earthquake Fire Expense Insurance (EFEI), and marine lines may incur losses, but low take-up rates and sub-limits should keep losses manageable.

Despite losses from Typhoons Nanmadol and Talas in 2022, Japan's non-life insurance segment experienced a relatively benign natural catastrophe year in 2023. Negative impacts on fire insurance profitability from the earthquake are expected to be offset by profits from other lines, with voluntary automobile insurance contributing significantly.

In response to declining fire insurance results, reference loss cost rates were revised upwards, supporting the long-term sustainability and profitability of the fire line. Overall, Japan's non-life profitability remains sustainable, with rate increases mainly observed in wind/flood layers during reinsurance renewals.

Advertise

Advertise