M&A deals to further consolidate Singapore’s life insurance industry

The top insurers are to gain more share in an already concentrated market.

Singapore’s life insurance industry is due for further consolidation in 2021 despite the top 10 insurers already accounting for 95% of the market share in 2020, the global analytics firm, GlobalData, said.

From 2017, the top 10 insurers increased their combined market share from 88% to 95% in 2020. This leaves 11 insurers to compete for the remaining 5%.

According to Swarup Kumar Sahoo, senior insurance analyst at GlobalData, recent mergers and acquisitions of some top insurers in Singapore will improve their market share this year.

“The merger of Singapore Life with Aviva will increase the market share of the combined entity to 9% in 2021. Similarly, the acquisition of AXA Insurance by HSBC will increase the market share of the combined entity to 3.6% and improve HSBC’s ranking from the 11th largest life insurer in 2020 to seventh-largest insurer in 2021,” Sahoo said.

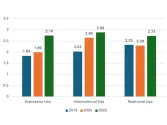

Sahoo added that the ranking of the top five life insurers in Singapore remained unchanged since 2016 with the Great Eastern Life and Prudential Assurance being the top two insurers in 2020.

Great Eastern Life is the largest player with a 25.5% market share in 2020. It was the only insurer amongst the top five life insurers to register growth in market share which increased from 21.2% in 2019 to 25.5% in 2020. Its gross written premiums (GWP) grew by 42% in 2020 after facing a decline of 7% and 9% in 2018 and 2019, respectively.

Prudential Assurance is the second-largest insurer with a 16.9% market share in 2020. The company’s market share declined from 18.6% in 2019 to 16.9% in 2020. However, in terms of GWP, the company registered a higher growth of 8% in 2020, as compared to 7% growth in 2019.

“Large customer base, diversity in products and economies of scale will help the leading insurers retain their market share in 2021. Decreasing profitability due to market consolidation may prompt the smaller insurers to increase premium rate in the short term,” Sahoo concluded.

Advertise

Advertise