Motor insurance segment in S. Korea to exceed $19b by 2028: GlobalData

Healthy loss ratio driven by lower claims will assist insurers in re-assessing their risk exposure.

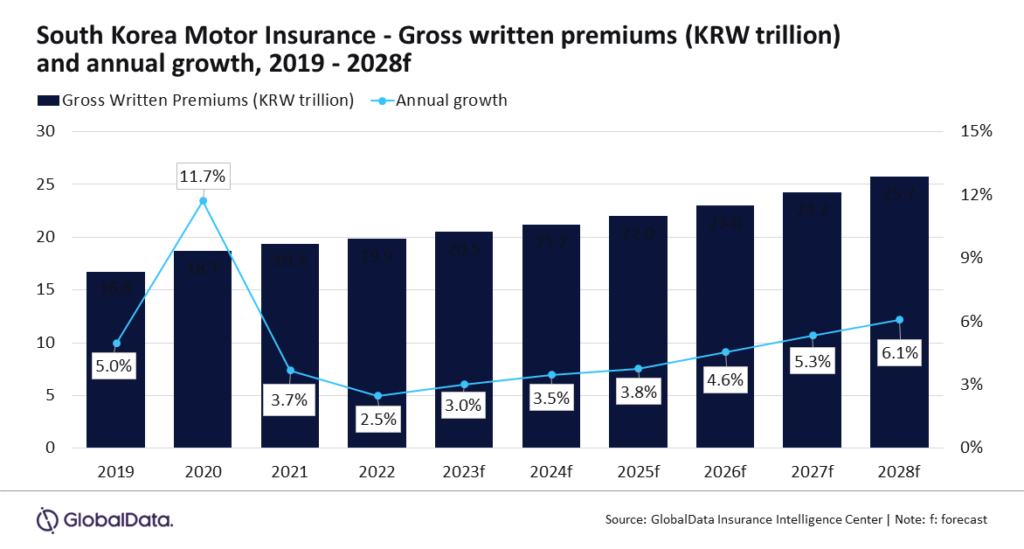

South Korea’s motor insurance market is projected to jump 4.6% in terms of compoud annual growth rate (CAGR) by 2028. This is equivalent to gross written premiums amounting to $19.2b in 2028 from $15.4b from 2023, according to GlobalData.

“The South Korean motor insurance industry witnessed a slower growth of 2.5% in 2022, which is expected to increase marginally to 3% in 2023. The slower growth was primarily driven by a semiconductor chip shortage and a subsequent rise in car prices, which led to lower vehicle sales,” said Anurag Baliarsingh , Insurance Analyst at GlobalData.

However, the industry is forecasted to pick up its pace in 2024 and return to pre-pandemic figures by 2027.

The motor insurance industry is expected to benefit from an increase in vehicle sales, which picked up pace in 2023 and is anticipated to continue in 2024.

Car prices have increased by around 10% on average compared to the previous year, leading to higher premiums for motor insurance.

A decline in motor insurance premium rates, driven by the stabilisation of insurers' loss ratio, is expected to impact growth over the next few years.

“The shift in the sales of motor insurance policies from face-to-face to digital mediums is another factor that is leading to a subdued growth of motor insurance premiums. The popularity of online aggregators and a rise in the online distribution of products have made motor insurance premium prices more competitive,” Baliarsingh said.

ALSO READ: Japanese life insurers poised to surge $350b by 2028: GlobalData

“Due to increased competition, smaller insurers have started offering policies at a lower price to maintain their market share, which has declined the average premium price of motor insurance policies,” Baliarsingh added.

Lower claims have improved insurers' loss ratios, resulting in a decrease in premium rates. This trend is anticipated to continue in 2024.

Moving forward, trends such as usage-based insurance are gaining popularity in South Korea.

Consumers are increasingly focusing on convenience and low-cost insurance products, leading to the rise of online distribution and usage-based motor insurance.

Whilst these trends contribute to the growth of the insurance market, they may also lead to slower growth of premiums due to the emphasis on cost-effective options.

“Recovery in the economy and increasing vehicle sales will support the growth of motor insurance during 2024-28. A healthy loss ratio driven by lower claims will also help South Korean motor insurers in re-assessing their risk exposure and cater to the changing market trends.” said Baliarsingh.

Advertise

Advertise