Noto earthquake saw $480m claims paid – GIAJ

Total claim payments received were 81,544.

General Insurance Association of Japan (GIAJ) data showed that the claims paid for the 2024 Noto Peninsula Earthquake as of 31 March was $480m (JPY74.42b).

The earthquake, which took place on 1 January, saw total combined claims figures from member companies of the GIAJ and the Foreign Non-Life Insurance Association of Japan.

ALSO READ: Total claims payout from Noto quake at JPY20.5B

Total claim payments during the period were 81,544, whilst the number of accepted claims was 128,263.

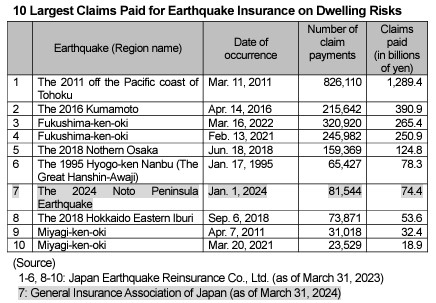

The GIAJ also released its “10 Largest Claims Paid for Earthquake Insurance on Dwelling Risks” data, which ranked the Noto earthquake at 7th place.

Advertise

Advertise