Pandemic puts brakes on Chinese general insurers

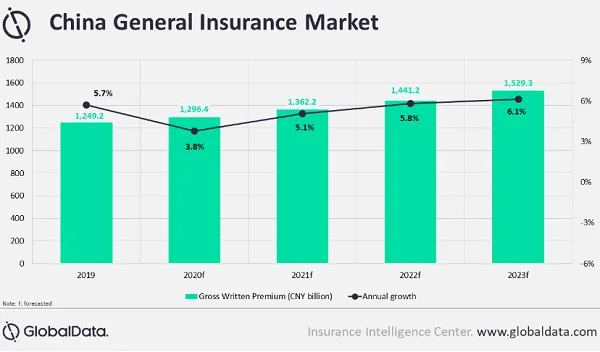

The sector is expected to just grow 3.8% this year.

China’s general insurance industry is set to slow down due to the pandemic, growing just 3.8% this year, according to a GlobalData report.

This is a departure from the 5.7% growth registered last year. The sector’s CAGR has now been adjusted from 8.6% to 5.2% for 2019 to 2023, mainly due to the scale-down of business activities and economic uncertainty.

“The recent floods will further dampen economic growth, resulting in lower premium growth for general insurers,” added GlobalData analyst Sangharsan Biswas.

The slowdown is most visible in the motor segment, which accounts for two-thirds of general insurance premium in 2019. From January to June, new vehicle sales dropped 16.9% due to reduced consumer spending and lockdown restrictions. As a result, motor insurance premium is forecast to slow down to 1.3%.

A similar trend can be observed in property insurance, which accounted for 10% of general insurance premiums last year. The suspension of economic activity in Q1 brought down sales of commercial properties by 5.4% in H1 on YoY, per the National Bureau of Statistics.

Slowdown in residential property sales and feeble global economic outlook is expected to limit property insurance growth.

Regulators are now looking into different strategies to boost business. The China Banking and Insurance, for example, is amping up digitisation and pushing insurers to expand offerings of smaller product lines such as environmental pollution liability cover.

Advertise

Advertise