Ping An reveals impact of transition to IFRS 17

Ping An will continue to disclose several important financial metrics regarding the impact.

Ping An Insurance said the impact of transitioning to International Financial Reporting Standard 17 (IFRS 17) on its total assets, total liabilities, and net assets is around 1%, indicating a smooth transition.

The China-headquartered insurer released an update on its adoption of the IFRS 17 and provided an explanation of the major changes and their impact.

The company disclosed its financial information for 2022 under IFRS 17 and highlighted that its adoption of the new standard will not alter its business nature or strategy, product offerings, solvency position, or asset-liability matching management significantly.

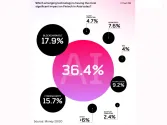

Profit indicators have shown varying increases, with operating profit for the group, life and health (L&H) insurance business, and property and casualty (P&C) insurance business increasing by 3%, 2%, and 14%, respectively.

Net profit also saw significant increases of 33%, 54%, and 14% for the Group, L&H business, and P&C business, respectively.

However, the group's 2022 revenue based on IFRS 17 dropped by approximately 19% due to changes in measurement methods.

To help investors and the public understand the impact of IFRS 17 on key financial indicators, Ping An will continue to disclose several important financial metrics, including return on equity (ROE), contractual service margin (CSM), new business contractual service margin (NBCSM), calculation of new business CSM margin, embedded value (EV), and new business value (NBV).

ALSO READ: World Bank taps Ping An Insurance executive for investment lab

The announcement further explains that under IFRS 17, the insurance contract revenue of the L&H business is impacted by the exclusion of the investment component and the recognition of revenue over the coverage period. This results in a significant decrease in revenue from long-term life insurance contracts. However, premium income remains unaffected.

The timing of profit and loss recognition in the L&H business will change under IFRS 17, but the operating components that drive business growth will remain consistent.

The L&H business will continue to utilize a value-based performance appraisal system, focusing on profit, new business value, investment, and operational quality.

The P&C business is relatively less impacted by the transition, as it continues to follow the premium allocation approach (PAA) under IFRS 17, with the combined operating ratio (COR) remaining a key profitability metric.

Advertise

Advertise