Property insurance in China could reach $41b in 2024

The industry saw a higher demand for property insurance driven by NatCat events in 2023.

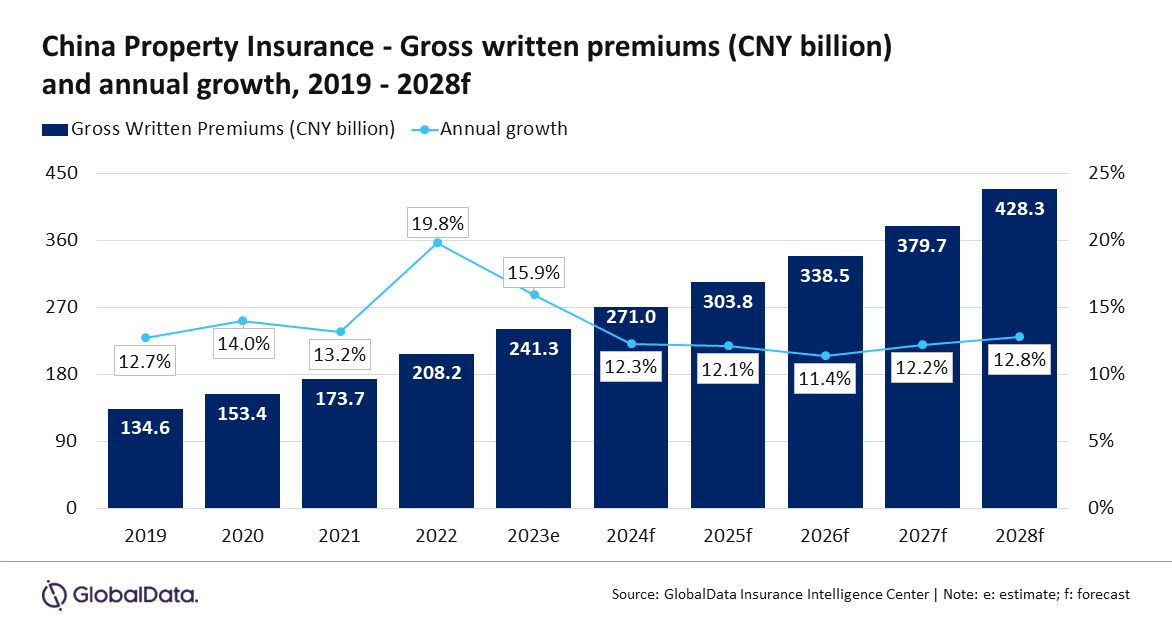

The Chinese property insurance industry is poised for substantial growth, with a forecasted CAGR of 12.1% from 2024 to 2028, or $40.5b to $67.7b in gross written premiums (GWP) by 2028, as per GlobalData.

In 2024, the industry is expected to grow by 12.3%, driven by favourable regulatory changes and increased demand for fire and home multi-risk policies due to frequent natural catastrophes.

“The Chinese property insurance industry witnessed a growth of 15.9% in 2023 due to higher demand for policies covering NatCat events, growing demand for agriculture insurance, and investments in infrastructure projects. The trend is expected to continue in 2024, which will support property insurance growth,” Manogna Vangari, Insurance Analyst at GlobalData, said.

Agricultural insurance, the largest product within the sector, is projected to grow by 15.3% in 2024, fueled by rising instances of extreme climate events like heat waves and heavy rains in China.

New standards issued by the Insurance Association of China in May 2023 aim to streamline online operations, facilitating faster underwriting and claim settlements for agricultural insurance.

ALSO READ: China life insurers to focus more on quality over premium growth: analyst

In April 2023, the China Banking and Insurance Regulatory Commission introduced trial regulations to enhance the agricultural insurance actuarial system, focusing on premium rate composition and adjustment, and insurers' adherence to non-life insurance actuarial principles.

Insurers are also encouraged to expand coverage, improve efficiency in underwriting and claim settlements, and develop products tailored to farmers' needs.

The escalating economic losses of $42b from natural disasters in the first nine months of 2023, as reported by the Emergency Management Ministry in October 2023, highlight the increasing NatCat risks driving property insurance demand.

Additionally, the growth of the construction industry, supported by substantial government infrastructure spending, is expected to boost property insurance growth between 2024 and 2027.

“China’s property insurance segment is poised for strong growth, driven by favorable regulatory developments, increasing demand for agriculture insurance policies, and growing construction activities. However, economic and geopolitical uncertainties as well as high NatCat losses will remain major challenges for property insurers over the next five years.” Vangari stated.

Advertise

Advertise