Singapore’s general insurance market slated for 6.4% in 2025

Thanks to regulation, economic growth, and demand for private health insurance.

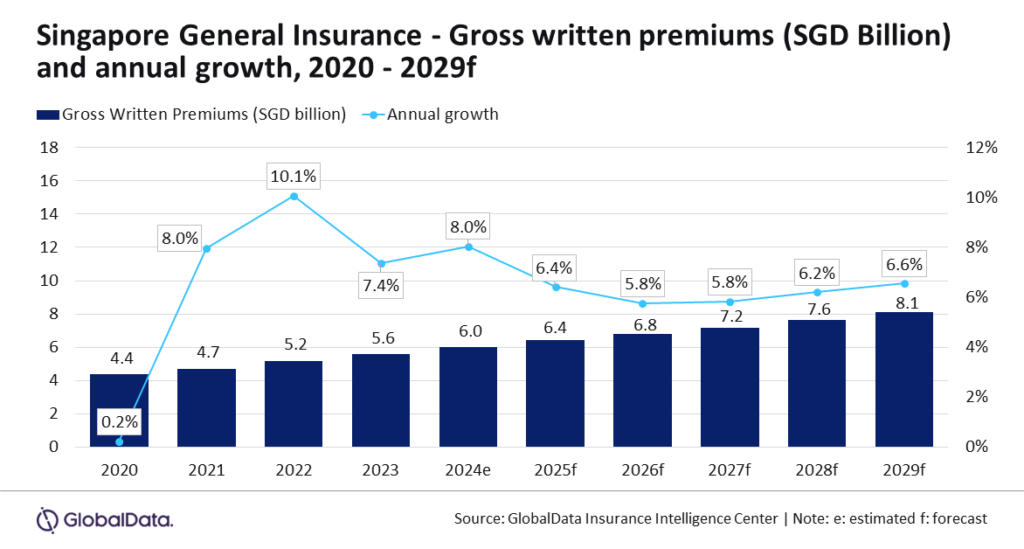

Singapore’s general insurance industry is expected to grow at a compound annual growth rate (CAGR) of 6.2%, reaching S$8.1b ($5.9b) in gross written premiums (GWP) by 2029, up from S$6.0b ($4.4b) in 2024, according to GlobalData.

Growth is projected at 6.4% in 2025, supported by regulatory developments, economic expansion, and increasing demand for private health insurance.

The industry’s profitability is expected to remain strong, with a combined ratio of 86% in 2024, indicating efficient claims and expense management, according to GlobalData senior insurance analyst, Swarup Kumar Sahoo.

The Monetary Authority of Singapore (MAS) has introduced several regulatory measures expected to boost market growth, including a streamlined insurance product approval process in November 2024 and the Cybersecurity (Amendment) Bill in May 2024.

In July 2024, MAS also issued Fit and Proper Criteria guidelines to ensure competence and integrity in the insurance sector.

Personal Accident & Health (PA&H) insurance is set to remain the largest segment, accounting for 23.8% of GWP in 2025, with an expected growth of 7.6%, driven by rising medical costs and increased tourism.

The country’s ageing population is also a factor, with those aged 65 and above expected to make up 24.1% of the population by 2030, supporting a CAGR of 6.8% for PA&H insurance from 2025 to 2029.

Motor insurance, the second-largest segment, is projected to account for 19.8% of GWP in 2025, growing by 6.2%, fueled by a rise in vehicle sales.

New vehicle registrations increased by 30% from January to October 2024 compared to the same period in 2023.

Growth in the electric vehicle (EV) and autonomous vehicle (AV) sectors, along with government initiatives to phase out diesel buses by 2040, is also expected to contribute to motor insurance expansion, which is forecasted to grow at a 3.6% CAGR from 2025 to 2029.

Property insurance, the third-largest segment, is expected to account for 17.9% of GWP in 2025, with a 5.1% growth rate, driven by increased construction demand and new public infrastructure projects. It is projected to grow at a CAGR of 7% over the next five years.

Other segments, including Liability, Marine, Aviation, Transit (MAT), and Financial Lines, will collectively account for the remaining 38.5% of GWP in 2025.

“The general insurance industry in Singapore is poised for steady growth from 2025 to 2029, supported by regulatory developments, economic growth, and evolving consumer needs,” Sahoo said.

“As insurers expand their digital capabilities and introduce innovative products, the general insurance market in Singapore is set to thrive over the next five years,” concluded Sahoo.

Advertise

Advertise