South Korea’s general insurance sector to hit $33.3b by 2029

Liability insurance, the second-largest segment, is expected to expand by 12.2% in 2024.

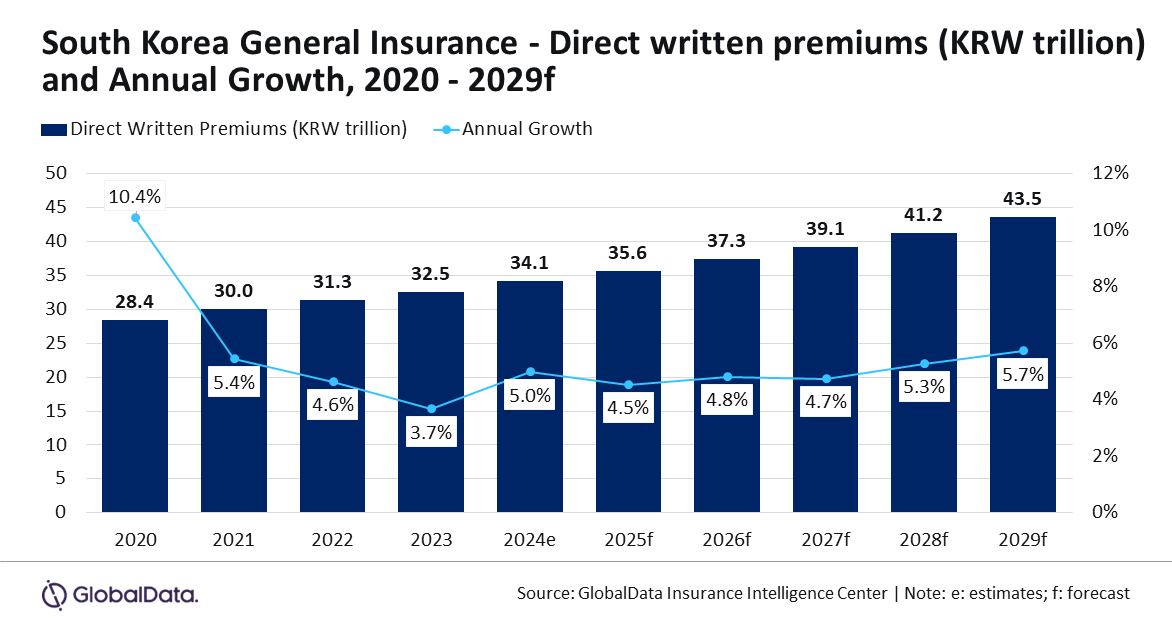

The general insurance sector in South Korea is expected to register a compound annual growth rate (CAGR) of 5.2% from 2024 to 2029, reaching $33.3b in direct written premiums, according to GlobalData.

For 2024, the sector is estimated to increase by 5%, influenced by economic recovery, regulatory mandates, and increasing demand for liability and health insurance.

“The South Korean general insurance industry may face potential premium price increases in the short-term due to the escalating geopolitical crisis in the Middle East that can potentially influence the prices of important commodities, given the country’s high reliance on trade,” Aarti Sharma, Insurance Analyst at GlobalData, said in a report.

Motor insurance, which accounts for 59.9% of the market, is set to grow at a modest 1.7% in 2024 due to declining vehicle sales.

However, rising repair costs, driven by inflation, are expected to support motor insurance growth at a 4.5% CAGR over 2025–2029.

Liability insurance, the second-largest segment with a 13.7% market share in 2024, is expected to expand by 12.2% in 2024.

Regulatory developments, including the Virtual Asset User Protection Act and revisions to the Personal Information Protection Act, are boosting demand for mandatory liability policies.

This line is projected to grow at an 8.1% CAGR through 2029.

Non-life personal accident and health (PA&H) insurance, driven by an aging population, rising medical costs, and longer wait times in public health services, is expected to grow by 14% in 2024, with a 5.1% CAGR forecast for 2025–2029. This segment accounts for 6.9% of DWP in 2024.

Other segments, including property, financial lines, marine, aviation, and transit insurance, contribute around 19.5% of the market in 2024.

Despite challenges, including potential premium price increases linked to geopolitical tensions, the market’s growth trajectory remains strong, supported by regulatory measures and evolving consumer needs, according to Sharma.

Advertise

Advertise