Why are few companies opting for AI-specific insurance?

Ransomware and phishing now worry 35% of executives.

Despite the rising risks, fewer than a third (30%) of companies purchase tailored insurance coverage to protect against bodily injury linked to technology-driven services, according to Beazley’s Digital Health & Wellness 2024 report.

Beazley’s research underscores the importance of adequate insurance as artificial intelligence (AI) driven technologies, like deep learning algorithms, pose complex risks. With AI often operating as a "black box," it becomes difficult to fully trust its recommendations or to pinpoint and correct biases, leading to heightened risk exposure.

According to a survey of 600 industry executives across Europe, North America, and Asia, executives are increasingly focused on issues of trustworthiness and bias as AI adoption accelerates in the sector.

Beyond AI concerns, supply chain and recruitment challenges have emerged as significant hurdles for digital health and wellness companies, with 29% and 28% of respondents citing these issues, compared to 17% and 16% in 2022.

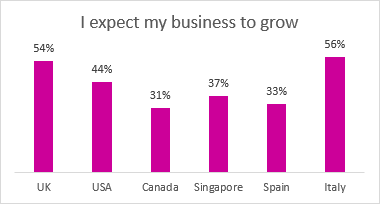

As a result, fewer than half (43%) of the businesses surveyed expect growth in 2024, with regional disparities influencing the outlook.

/Beazley

Only 37% of respondents from Singapore expect their businesses to grow. Italy and the UK had the highest expectations for growth, with 56% and 54%, respectively.

Cybersecurity threats and competency risks remain top of mind for executives. Concerns about misrepresentation of competency in treatment or advice have increased to 38%, up from 24% in 2022.

Meanwhile, cyber risks, such as ransomware and phishing, now worry 35% of executives, compared to 27% in 2022.

Advertise

Advertise