ZA Bank launches short-term savings insurance in Hong Kong

The insurance has a 3.11% p.a guaranteed returns.

Hong Kong virtual bank ZA Bank has launched a short-term, high-return savings insurance product.

Called ZA Savings Insurance 3, the short-term savings insurance plan features a guaranteed return of 3.11$ per annum (p.a). The plan seeks to help users achieve their dual goals of capital preservation amidst the current rate hike cycle and wealth growth within a short period of time.

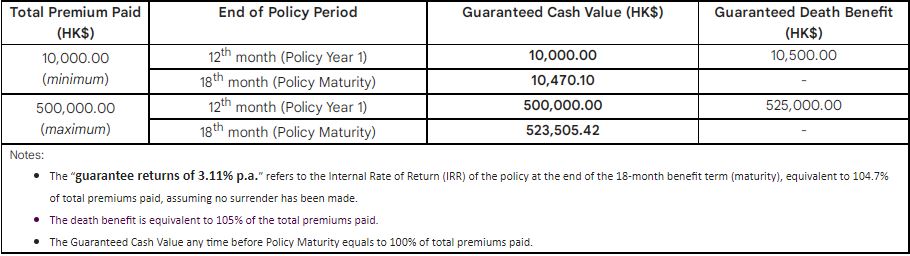

Denominated in Hong Kong dollars with an 18-month locked-in period, ZA Savings Insurance 3 offers 100% capital protection for the entire benefit term and helps protect users against inflation with its guaranteed returns of 3.11% p.a. at maturity. Users can start the plan at $1.27k (HK$10k). The plan also offers a lump-sum death benefit of 105% of total premiums paid.

The plan is subject to a limited quota on a first-come-first-served basis. The maximum premium for each insured person and policy is capped at $63.71k (HK$500k).

An estimate of possible benefits is illustrated below:

Only Hong Kong residents with Hong Kong Identity Card are eligible to avail this product.

Advertise

Advertise