India

Howden appoints new managing director, head of M&A for India

Howden appoints new managing director, head of M&A for India

She has more than 20 years of experience.

SBI Life insurance pencils 27% YoY profit surge in FY 2025

New Business Premium stood at $426.92m.

India’s life insurers post 5.1% growth in FY 2025 premiums

CareEdge said premium growth is expected to remain volatile.

GAIP appoints Rohit Boda as India head, non-executive director

This is in line with GAIP's expansion goals in India.

India’s non-life insurance sees flat growth in FY 2025

It was dragged by the low passenger vehicle sales growth during the period.

India’s insurance penetration rises to 41% on public schemes growth

India’s healthcare and hospital sector is moving to aggressive expansion.

ICICI Lombard earnings surge 30% YoY in FY 2025

Gross written premiums for FY 2025 also climbed 10.4%.

Willis selects Anant Pawar to lead aviation insurance in India

He brings over 27 years of experience in the insurance and reinsurance industry.

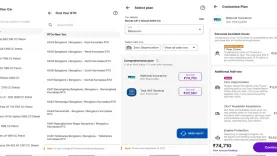

Half of Indians risk financial strain by selecting insufficient health coverage

51% incorrectly believe that critical illness treatments cost less than Rs5 lakh.

PNB MetLife launches pension multicap fund with Policybazaar

It will be open for subscription from 1 to 15 April at a NAV of ₹10.

Health insurance coverage in India projected to reach 50% by 2025

Yet, rural healthcare infrastructure and trained talents remain key challenges.

Insurance Brokers Association of India unveils new President

He takes over from outgoing President Sumit Bohra.

The increasing number of affluent individuals in India and their evolving insurance needs

As India’s affluent population continues to grow, their insurance needs will become increasingly complex.

Peak Re obtains reinsurance branch license to operate in India’s GIFT IFSC

The approval allows Peak Re to conduct both property and casualty (P&C).

BFSI sector leads cyber insurance adoption at 35% to 40% share

This was followed by the technology and IT sector at 30%.

India’s PhonePe unveils new vehicle insurance for as low as $0.012

Customers can save up to ₹4,000 on a two-wheeler insurance, PhonePe claims.

India non-life insurers face impact from 1/n rule transition: CareEdge

Despite decline, experts predict premiums for to exceed Rs3 lakh.

Advertise

Advertise