Cebuana Lhuillier

Cebuana Lhuillier is the leading microfinancial services provider in the Philippines. Established in 1953 under Agencia Cebuana and later adopting its trade name Cebuana Lhuillier in 1987, this distinguished Filipino company has been dedicated to fulfilling its vision of empowering Filipinos through accessible financial services.

See below for the Latest Cebuana Lhuiller News, Analysis, Profit Results, Share Price Information, and Commentary.

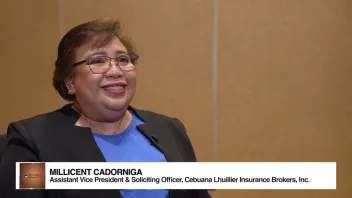

Insurance Asia Awards 2025 Winner: Millicent Cadorniga of Cebuana Lhuillier Insurance Brokers, Inc.

Insurance Asia Awards 2025 Winner: Millicent Cadorniga of Cebuana Lhuillier Insurance Brokers, Inc.

Millicent Cadorniga of Cebuana Lhuillier Insurance Brokers, Inc., highlights how their digital innovation is transforming the Filipino experience.

Insurance Asia Awards 2024: Cebuana Lhuillier Insurance Brokers Inc.

Anthony Lou Bernabe, General Manager & Group Head for Insurance at Cebuana Lhuillier Insurance Brokers Inc., discusses their heritage driven by innovation, technology, and customer focus dedicated to serving the Filipino market with their launch of innovative products like HealthMax and Cebuana Lhuillier Miners Protect.

Cebuana Lhuillier Insurance Brokers named Domestic Broker of the Year - Philippines at Insurance Asia Awards 2024

The Philippines' leading insurance firm has been recognised for its impactful initiatives aimed at democratising insurance access across all socioeconomic classes.

Advertise

Advertise

Commentary

India’s cyber risk paradox: High attack rates, low insurance preparedness