Great Eastern digitises processes to reach untapped Indonesian insurance market

This effort succeeded in optimising their financial performance with a net profit of $ 1.98m (IDR 31b)

Indonesia’s insurance market is an untapped resource, with only less than 10% of the population insured. To make insurance more accessible and convenient, Great Eastern Life Indonesia has created a comprehensive digitisation process, from customer onboarding to after-sales service.

The firm’s digital transformation is also in line with Indonesian Life Insurance Association (AAJI) call to prioritise easy access for the public to obtain insurance products and services with the principles of customer centricity, customer protection, and digital experience.

"One of the steps we are taking is to utilise technology so that customers can have additional options to connect with us digitally," President Director Clement Lien Cheong Kiat told Insurance Asia.

Five digital ecosystems

Five years ago, Great Eastern Life Indonesia has taken towards its digital transformation. Now, it has five comprehensive digital ecosystems to make the insurance process more efficient for customers.

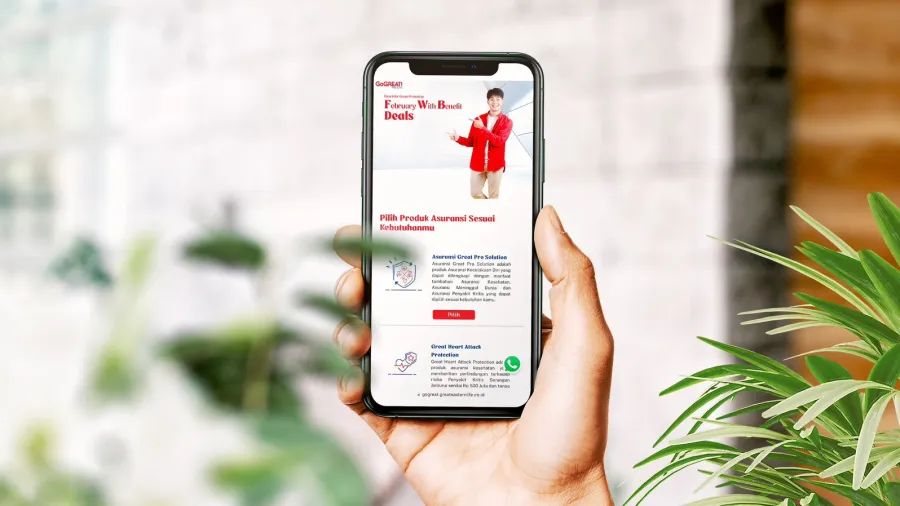

The first ecosystem is called the GoGREAT! Services Customer Portal. It is a portal for individual insurance customers where they can make Fund Switches (for customers with unit-linked policies), view policy information and insurance benefits, view personal information, change the frequency of premium payments, change premium payment methods, download transaction reports, e-policies, as well as e-endorsements.

Second, GoGREAT! Sales Website, the website for purchasing insurance online. Third, the Great Eastern Corporate-ID (GEC-ID) application for Group Insurance customers. "Through this application, customers can view benefit details, claim history, submit e-claims, consult online doctors, and make appointments with doctors," said Clement.

Fourth is the HR/Broker Portal for Group Insurance customers. "Here, corporate HR can manage dashboards, view insurance benefit details, view participant information, add and/or remove participants, and manage premium bills and excess claims," said Clement.

The last ecosystem, Great Advice, is a Mobile Point of Sales for marketing staff (Financial Advisor / FA). Through Great Advice, FAs can input Life Insurance Requests online.

“We have provided various easiness for customers to connect with us. Customers can access their policies on the Customer Portal in just 3 easy steps: enter their KTP/Passport number, enter the Policy Holder's Date of Birth, and enter the One Time Password (OTP) sent to the customer's mobile number," said Clement who also added that by this digitization, customers can avoid the risk of losing transaction submission documents.

Closing the inclusion-literacy gap

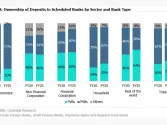

But of course, with the easiness that they provide, Clement realises that at the same time, they also need to increase financial literacy. He pointed out that the 2022 National Financial Literacy and Inclusion Survey (SNLIK) still found a fairly high gap between the financial literacy index (49.68%) and financial inclusion (85.10%). This data means that out of every 100 Indonesians, there are 85 people who are inclusive in using financial products/services, but only 49 understand it correctly.

Therefore, apart from creating easy access for customers, Great Eastern Life Indonesia also educates the public through various financial literacy class programs to help customers understand financial planning. "So that through this program customers who understand their financial needs can have a better plan for their future," said Clement.

Great Eastern Life Indonesia also present a program to understand products that suit their needs and financial goals. “Each product is designed according to different needs. The main key is identifying the right product so that customers can meet their needs," said Clement.

With these efforts, Clement believes it will bring more positive impact on business growth, especially because the digital transformation which been carried out can be correctly understood and accessed by public.

The results of its digital transformation include insurance claims in the Great Eastern Corporate application which cutting claim duration from seven days to three days. In addition, financial performance is increasingly optimal with a net profit in Q4 2022 of $ 4.26m (IDR 66b). Total assets increased by 21% to $ 634.09m (IDR 9.9t) (year on year) and the solvency ratio reached 499% or exceeded the requirements set by the Financial Services Authority (OJK), which was 120%.

“When we identify something that we can improve through digital solutions, we will actively develop it to ensure our customer experience remains good,” said Clement, although he also said he would retain some of the conventional services for customers who prefer to do face-to-face. “Because in essence, we believe that in the future there will be more and more customers who want to connect with companies directly rather than through intermediaries," he concluded.

Advertise

Advertise