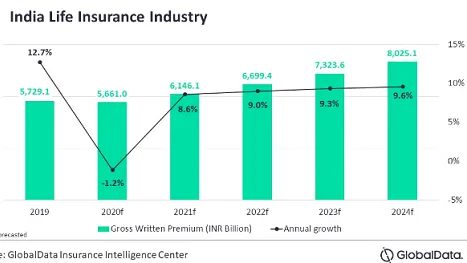

India's life sector projected to hit $98.5b in GWP by 2024

Catalysts include favourable demographic factors and economic recovery expected over H2 2021.

The Indian life insurance sector will reach $98.5 billion (INR8t) in gross written premiums by 2024 at a compound annual growth rate of 7% from 2019 to 2024, projects a GlobalData report.

Catalysts include favourable demographic factors and economic recovery expected over the second half of 2021.

In addition, the high number of deaths due to COVID-19 has led to an increased insurance awareness, coupled with the easing of lockdown restrictions and higher adoption of digital distribution channels, according to GlobalData Analyst Manisha Varma.

“Digital distribution got a much-needed push as insurers are focusing on ensuring uninterrupted sales support and customer service. Insurers are also offering new products with COVID-19 specific benefits to push sales. In January 2021, new business premiums grew by year-on-year 3.7% to $2.98 billion (INR213.9 billion),” she said.

The positive regulatory developments witnessed in the last six months are also expected to support sector growth, including the increase in foreign direct investment limit in insurance to 74% which will push foreign insurance to dip their toes in the market and bring additional capital.

Also, in April this year, the regulator allowed insurers to invest up to 10% of their outstanding debt instruments in a single infrastructure investment trusts and real estate investment trusts issue, which will reinforce insurers’ financial positions and give them the push to expand their product offerings.

Advertise

Advertise