APAC PA&H insurance premiums to more than double in 2026

The segment is growing at an annual growth rate of 13%.

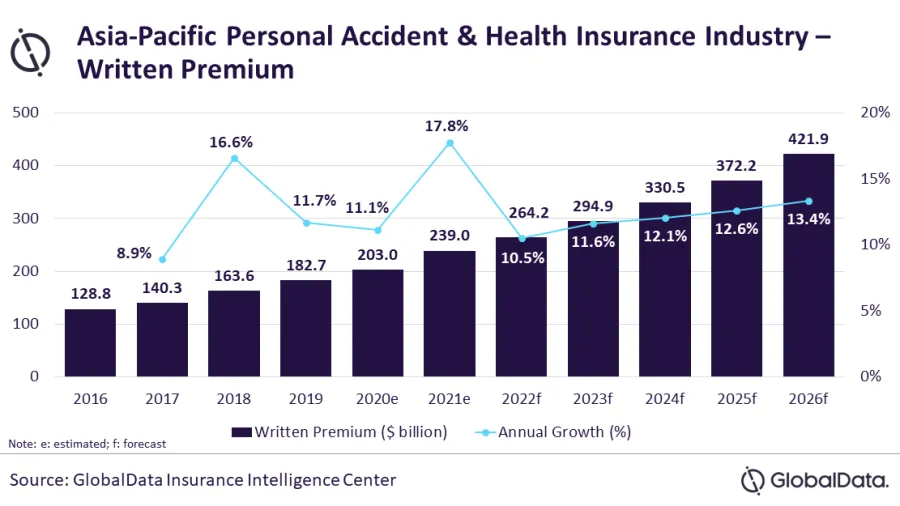

Personal accident and health (PA&H) insurance in Asia Pacific is predicted to grow from $203b in 2020 to $421.9b in 2026 in terms of written premiums according to a report by GlobalData.

The PA&H segment is growing at a compound annual growth rate (CAGR) of 13%, backed by increased awareness and growing disposable income.

According to GlobalData Senior Insurance Analyst, Deblina Mitra, the APAC PA&H insurance segment peaked at 17.8% in 2021, driven mostly by economic recovery and increased insurance awareness in the region.

“The region’s emerging markets with underdeveloped public healthcare systems struggled during the pandemic to deliver healthcare due to a surge in demand beyond their capacity, compelling individuals to seek private healthcare, driving insurance sales,” Deblina said.

The report said that China is seen to be leading the PA&H insurance market in APAC, with a 69.5% share of written premiums in 2021. GlobalData identified the growing middle-income population, tax exemption, traction in remote healthcare services, and rising medical expenses as the major factors behind the growth.

“The formation of a new national pension company in 2021 to develop health insurance is expected to create substantial business for PA&H insurers from China’s $1.2 trillion pension sector. The PA&H insurance industry in China is expected to grow at a CAGR of 15.8% from 2020-2026,” Deblina said.

Meanwhile, Australia has a share of 8.5% of written premiums in 2021 and is the second-largest market in APAC. The PA&H insurance industry in Australia is expected to grow at a CAGR of 5.1% over 2020-2026 with the lifting of restrictions on international travel, and awareness of mental health and well-being.

“With every one in five Australians experiencing mental health issues, the demand for health insurance covering mental health witnessed growth. Psychology services and in-patient treatments/ rehabilitation are some of the mental healthcare services that are available under private health insurance,” Deblina added.

Rounding the top five markets in the region is Taiwan, India, and Japan, with a combined share of 15.4% in 2021. PA&H insurance in the three countries is expected to grow at a CAGR of 4.5%, 9.8%, and 3.3%, respectively, until 2026.

“Economic growth and pandemic-led awareness coupled with the revival of the tourism sector will favor PA&H insurance’s growth over the coming years. Product innovation centering around personalization and inclusion of mental healthcare will be focus areas for insurers,” Mitra concluded.

You may also like:

EXCLUSIVE: The life-changing ‘crash’ of PGA Sompo’s CEO

Advertise

Advertise