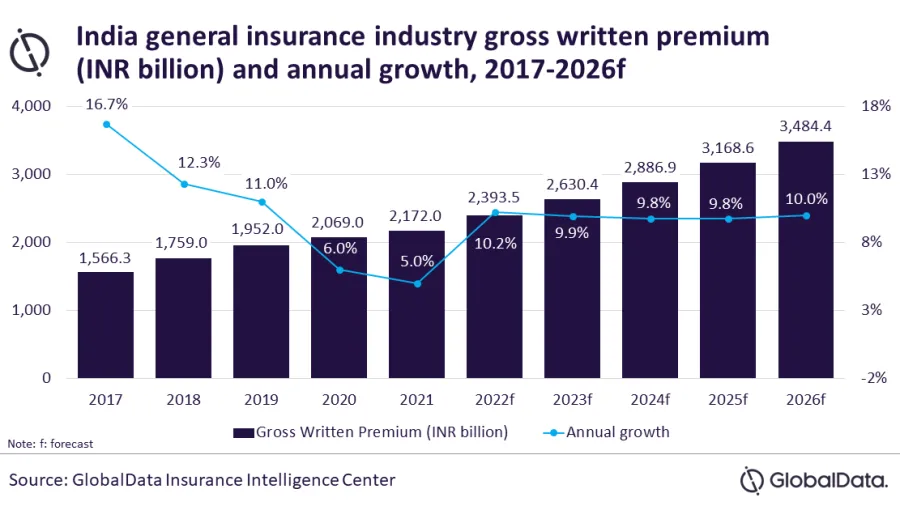

India general insurance industry doubles growth rate in 2022

From 5% in 2021, it is forecasted to grow by 10.2% by end 2022.

India’s general insurance industry is poised to double its compound annual growth rate (CAGR) to 10.2% by end 2022 from its slowest growth of the decade at 5% from 2021, according to data and analytics firm GlobalData.

The industry is expected to grow at a CAGR of 9.9% to $41.78b in the next five years to 2026. According to GlobalData’s senior insurance analyst Shabbir Ansari, India’s general insurance industry is poised for a strong recovery in 2022, driven by increase in awareness and demand for health insurance and an economic recovery, which has helped automobiles and property demand reach its pre-pandemic levels.

India’s low base of 5% was because of the sluggish performance of motor and property insurance lines due to the COVID-19 pandemic that negatively impacted the general insurance industry in India in 2021.

Personal accident and health (PA&H) insurance was the largest segment, accounting for 33.8% of general insurance GWP in 2021. It grew by 14.% in 2021 due to a surge in demand for health insurance policies following the COVID-19 pandemic. This trend will continue over the forecast period as the PA&H segment is expected to grow at a CAGR of 11.7% over 2021-26

Meanwhile, motor insurance, the second-largest segment, accounted for 33.3% of GWP in 2021. It registered a sluggish growth of 2.7% due to lower vehicle sales following the economic slowdown and shortage of automobile chips globally. The motor insurance segment is expected to recover in 2022 and grow by 8.8%, in-line with recovery in automobile sales.

“India’s general insurance penetration of 0.9% in 2021 is very low compared to the top five countries in the region - South Korea (5.1%), Australia (3.5%), New Zealand (2.1%), Japan (1.8%) and Hong Kong (1.6%). As a result, there are ample opportunities for growth and expansion in the Indian general insurance industry,” Ansari said.

You may also like:

Taiwan insurance industry suffers double digit drops in April

Advertise

Advertise