Korea P&I Club’s maritime relationships keep strong domestic presence – AM Best

Underwriting performance is also seen to improve in the next few years.

Korea P&I Club (KP&I) is expected to maintain a stable presence in the domestic market due to its capable relationship with South Korean shipping companies, said AM Best.

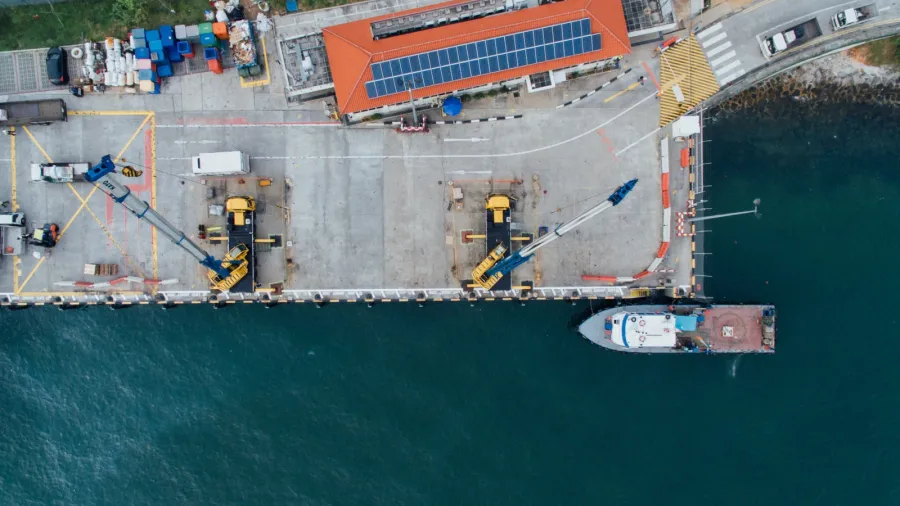

KP&I's footprint in the global P&I market is relatively modest compared to the International Group of P&I Clubs, primarily centred in South Korea with a focus on smaller vessels.

The Club receives extensive governmental support due to its strategic role in South Korea's maritime infrastructure development. Support includes subsidies, tax exemptions, no dividend policy, and diplomatic efforts.

AM Best's assessment considers KP&I's strong balance sheet, adequate operational performance, limited business profile, and appropriate risk management.

ALSO READ: Investment risk to concern China BOCOM Insurance – AM Best

KP&I showed robust risk-adjusted capitalisation, rated at the highest level according to Best's Capital Adequacy Ratio (BCAR).

This strength is projected to persist in the intermediate term, underpinned by low underwriting leverage and a highly conservative investment portfolio.

While underwriting performance suffered volatility due to changes in reinsurance structure, KP&I has taken robust measures to mitigate this, including premium increases, policy non-renewals, and enhanced terms.

This is expected to improve underwriting fundamentals and reduce profit volatility over the next years.

Advertise

Advertise