SG’s property insurance to stay afloat in 2023 – GlobalData

Disciplined underwriting and well-diversified portfolios will support profitability, an analyst said.

Singapore's property insurance industry is expected to remain profitable in 2023, thanks to disciplined underwriting practices, sufficient reinsurance coverage, and rising premiums from compulsory fire insurance, according to GlobalData.

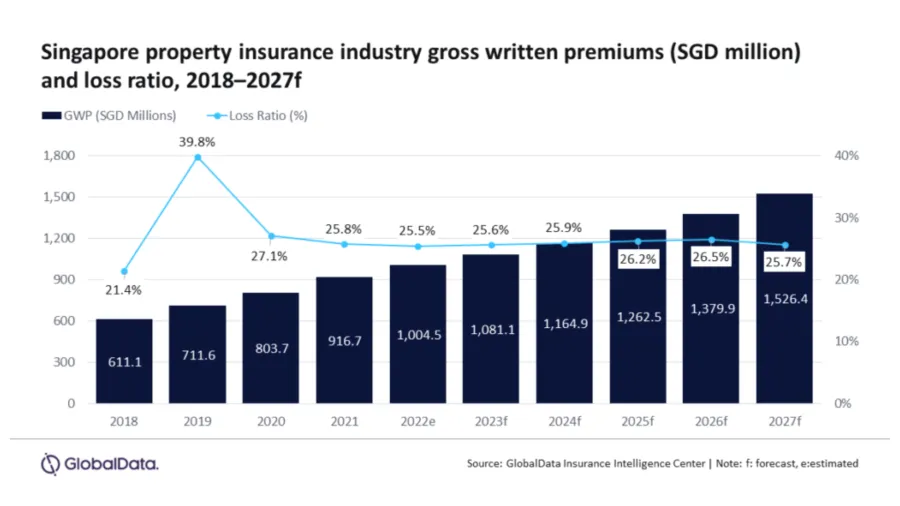

The property insurance market in Singapore, as measured by gross written premiums, is projected to grow at a compound annual growth rate (CAGR) of 8.7% from S$1.0b ($0.7b) in 2022 to S$1.5b ($1.1b) in 2027.

This growth is primarily driven by compulsory fire insurance, which is mandatory for Housing and Development Board (HDB) homebuyers and those taking out home loans. HDB data indicates that over 75% of Singapore's resident population resides in HDB flats.

GlobalData's insurance database indicates that property insurers in Singapore achieved an underwriting profit margin of 28.5% in 2021 and are expected to maintain margins above 25% in 2022 and 2023.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, notes that despite the rise in inflation leading to higher claims payouts, Singapore's property insurers are expected to remain profitable in 2023 due to robust reinsurance coverage, which helps mitigate risk in the event of higher claims.

ALSO READ: Indian life insurance industry to reach $170b in four years: Global Data

In 2021, property insurers in Singapore ceded 72.6% of their business to reinsurers, up from 65.8% in 2017, indicating a trend towards maintaining underwriting profitability.

“Disciplined underwriting along with well-diversified portfolios will support insurers’ profitability in Singapore. The top 10 property insurers in Singapore accounted for 67% of the property insurance market in 2021. They generated on an average, 41% of their business from property insurance, 19% from liability insurance, 14% from motor, and 14% from non-life PA&H insurance. Such diversification helps in managing risk arising due to loss in any single line of business.” Sahoo said.

However, Sahoo warns that while Singapore's property insurers have maintained profitability, factors like high inflation and global economic uncertainty could potentially impact their profitability in the future.

Advertise

Advertise