Global insurtech investments impress Q3 expectations: Gallagher Re

P&C insurtech investment mainly pushed the quarter’s growth.

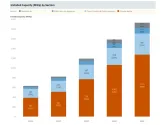

During the third quarter (Q3) global insurtech sector experienced a significant uptick, surpassing $1.1b in new funding, driven by a 25.5% quarter-on-quarter surge in Property & Casualty (P&C) insurtech investment, as reported in the latest Global insurtech Report from Gallagher Re.

Dr. Andrew Johnston, Global Head of Iinsurtech at Gallagher Re, highlighted the industry's shift from the 'great experiment' to a focus on sustainable, profitable outcomes.

He emphasised the importance of learning from past mistakes, particularly regarding capital management, and highlighted the critical role technology and new entrants can play in enhancing reinsurance value.

Despite a 16.4% decrease in average deal size to a six-year low of $10.3m, the number of insurtech deals rose from 97 in Q2 to 119 in Q3.

ALSO READ: InsurTech funding down 34% in Q2: Gallagher Re

P&C insurtech accounted for 90 deals, and Life & Health insurtech for 29. Notably, US-based insurtechs claimed 55.4% of the global deal share, reaching the highest level since Q1 2020.

Early-stage insurtech funding saw a 24.7% increase to $269.45m in Q3, with the number of early-stage deals rising from 51 to 71.

Conversely, mid-stage Series B and C funding for the year fell to its lowest total since 2014, reaching $24m. Two mega-rounds in Q3, each raising $100m, were secured by Openly and Resilience.

(Re)insurers made 34 insurtech investments in Q3, with the majority in the early-stage category (61.8%).

Notably, MassMutual Ventures led with seven investments, while Avanta Ventures, MS&AD Ventures, and Munich Re Ventures each made three or more investments.

Advertise

Advertise