Air India crash raises pressure on global aviation reinsurers

Claims from this single event could potentially exceed the entire annual premium.

The crash of Air India flight AI171 on 12 June, which killed 241 passengers and crew, is set to intensify pressure on the already hardening global aviation reinsurance market.

The incident, involving the first-ever fatal hull loss of a Boeing 787-8 Dreamliner, is expected to significantly impact aviation insurers and reinsurers both in India and globally, according to GlobalData.

In 2023, India’s domestic aviation insurance direct written premium (DWP) stood at $127.8m.

Claims from this single event could potentially exceed the entire annual premium, GlobalData analyst Swarup Kumar Sahoo said.

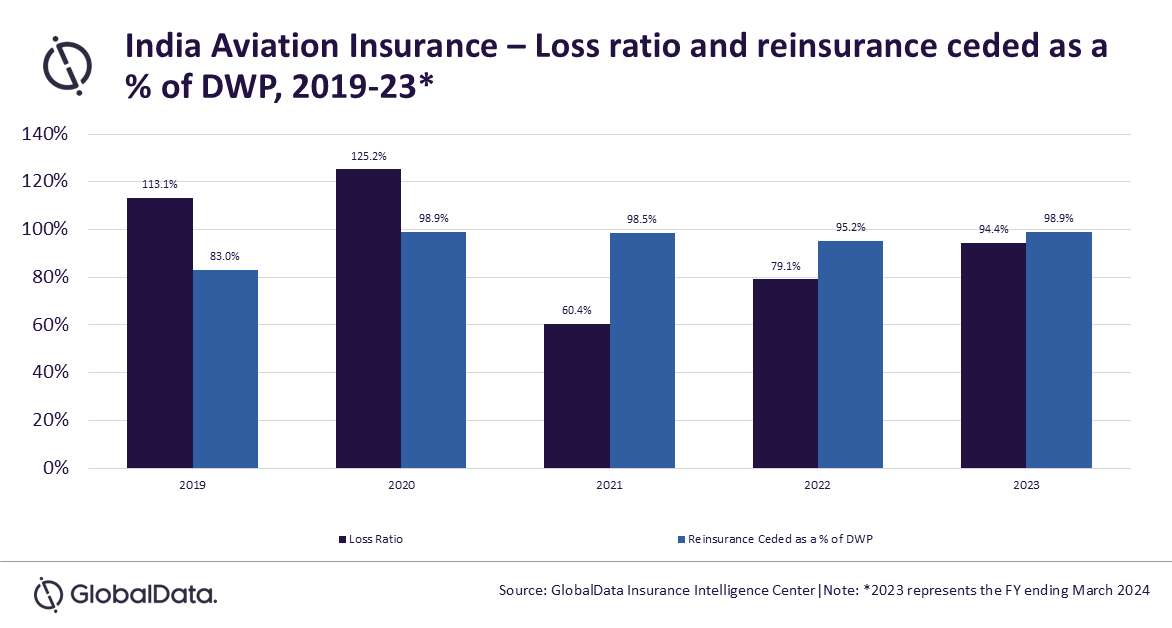

Indian insurers typically cede over 95% of aviation premiums to global reinsurers, meaning the financial burden will largely fall on international players.

New India Assurance and Tata AIG are the primary insurers involved. However, their exposure is limited as aviation only made up 1.1% and 1% of their total premiums, respectively.

Both firms have reinsured the majority of their aviation risk. State-owned reinsurer GIC Re holds around 5% exposure due to compulsory cession requirements.

India's aviation insurance sector has been loss-making, attributed to recurring incidents including damage to aircraft operated by Jet Airways and SpiceJet, and a previous crash involving a Su-30 fighter jet.

The Air India crash is expected to further strain the sector.

The total insurance cost from the crash is projected to exceed $200m.

This includes the aircraft value, estimated between $75m and $80m, and passenger liability costs under the Montreal Convention and domestic laws.

GlobalData expects the event to drive a reassessment of reinsurance structures and contribute to rate increases in the 2026 renewal cycle.

The Indian government is also considering grounding Boeing 787-8 aircraft, which could lead to business interruption claims, further affecting the profitability of insurers with exposure to these risks.

Global reinsurers are expected to respond by tightening underwriting terms, increasing premiums, and reassessing exposure to wide-body aircraft, GlobalData said.

Advertise

Advertise