Australia’s life insurance market set to hit $19.8b by 2029

Medical inflation remains one of the biggest drivers of rising claims costs.

The life insurance market in Australia is forecasted to reach $19.8b in 2029, driven by a combination of demographic shifts, economic factors, and innovation in insurance products, GlobalData said.

“Insurers are expected to focus on developing flexible and cost-effective solutions to meet the needs of a diverse consumer base,” Swarup Kumar Sahoo, Senior Insurance analyst from GlobalData, said in a report.

“The demand for life insurance is expected to grow, driven by a heightened awareness of financial security and the need for comprehensive coverage in an uncertain economic landscape,” Sahoo added.

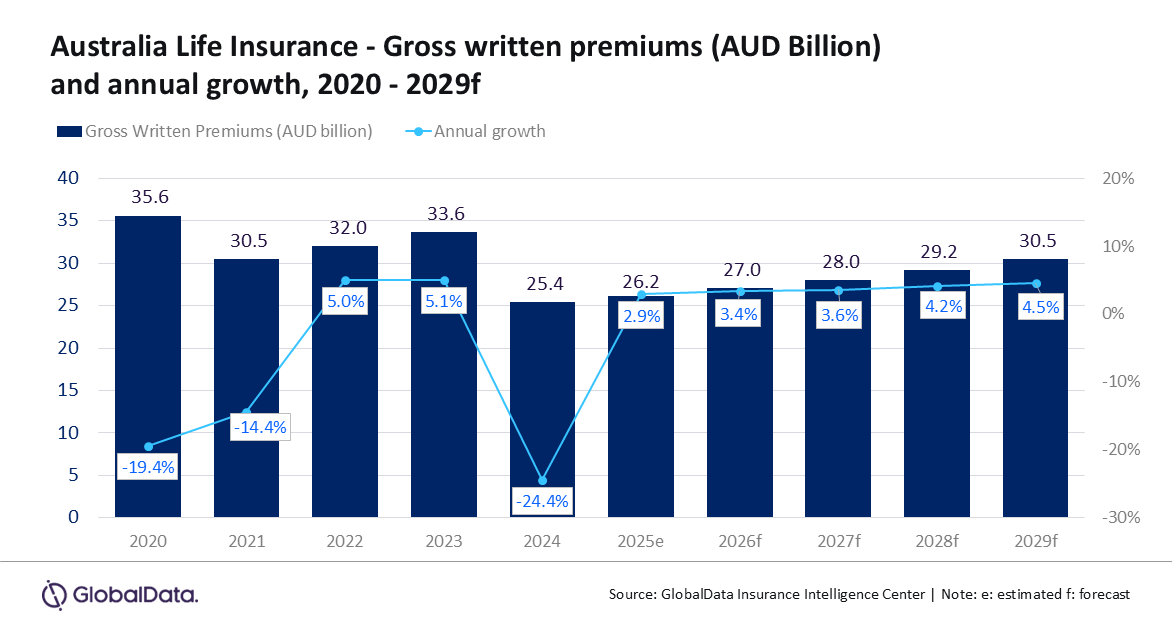

The industry is also projected to register a compound annual growth rate (CAGR) of 3.9% in terms of gross written premiums (GWP) from 2025 to 2029.

Australia’s life insurance market is also estimated to reach a 2.9% CAGR this year.

It’s growth forecast is likely “supported by economic recovery, an aging population, increased health awareness, and escalating cost of living. Additionally, the recovery in household disposable income and consumption is expected to boost demand for life insurance products.”

The firm also notes that the decline of 24.4% in life insurance premiums in 2024 was driven by reporting changes following the adoption of IFRS 17.

Medical inflation remains one of the biggest drivers of rising claims costs.

The Australian Bureau of Statistics reported a 4.1% increase in health inflation in the first quarter of 2025 compared to a year earlier, which is expected to influence product pricing.

Ageing demographics are also reshaping demand. The share of Australians aged 65 and above is projected to exceed 22% by 2026, up from 16% in 2020.

GlobalData expects this shift, along with policy reforms such as the Aged Care Act 2024, to lift awareness around financial planning and support demand for life and health products.

Personal accident and health insurance premiums, which grew at a CAGR of 3.8% between 2020 and 2024, are forecast to grow at 4.6% between 2025 and 2029.

However, the cost-of-living crisis continues to pressure household budgets. A Cost of Living Index report shows 71% of Australians worry they may not be able to maintain or purchase life insurance.

GlobalData says affordability concerns are driving higher lapse rates and will likely push insurers to improve retention strategies.

Advertise

Advertise